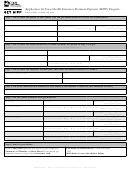

Form De-103 - Application For Ahcccs Health Insurance And Medicare Savings Programs Page 6

ADVERTISEMENT

SPOUSE’S INFORMATION, If living together

Spouse’s First and Last Name

Spouse’s Date of Birth

Spouse’s Social Security Number (optional if not

applying)

Y

No

es

If applying, Spouse’s Medicare Claim Number

Is your spouse applying for AHCCCS Health Insurance?

Y

No

es

Is your spouse applying for help to pay Medicare Costs?

Y

No

es

Does your spouse need help paying for medical bills

from the last three months?

What months? ________________ _________________ _________________

Y

No

es

Would your spouse like to register to vote?

Hispanic

Non-Hispanic Latino

If applying, Ethnic Group of Spouse (Optional)

White

Asian

Native American Tribe:_______________

If applying, Race of Spouse (Select one or more) (Optional)

Black/ African American

Alaska Native

Hawaiian or other Pacific Islander

If applying, is your spouse a U.S.

What is your spouse’s immigration status?

Citizen?

❑Asylee

❑Afghan/Iraqi Special Immigrant

❑Refugee

❑Yes, a U.S. citizen

❑Battered Alien

❑American Indian Born in Canada

❑Conditional Entrant

❑ Cuban-Haitian Entrant

❑Deportation Withheld

❑ Hmong or Laotian Highlander

❑No, not a U.S. citizen

❑Indefinite Detainee

❑Lawful Permanent Resident (LPR) ❑Parolee for at Least One Year

If no, what number is on your

❑Victim of Trafficking

❑Other

spouse’s immigration card?

A_________________________

DEPENDENT CHILDREN INFORMATION

Do you have any unmarried children living with you who are under age 18 or under age 22 and a student? ❑ Yes

No

If YES, list below. If you need more space, attach a separate piece of paper with the information requested.

Child’s Full Name

Type of School, If Student

Child’s Date of Birth

Child’s Social Security No.

(Last, First)

(optional)

A.

B.

Spouse

NON-FINANCIAL INFORMATION

Applicant

(if applying)

Yes

No

Yes

No

1. Do you live in Arizona?

Yes

No

Yes

No

2. Do you receive Medicare Part A?

Yes

No

Yes

No

3. Do you receive Medicare Part B?

Yes

No

Yes

No

4. Have you been determined blind or disabled by the Social Security Administration?

Yes

No

Yes

No

5. If you answered NO to number 4 and you are under age 65, do you have a disability that has

kept or will keep you from working for at least 12 months?

Yes

No

Yes

No

6. Are you a person under age 65 who has lost Title II Social Security Disability benefits

because of earnings?

INCOME

Do you, your spouse, or your dependent children receive or expect to receive any of the following types of income?

Check YES or NO for each item.

Yes No

Yes No

Yes No

Employment Income

Veteran’s Benefits

Rental Income

Yes No

Yes No

Yes No

Self Employment Income

Annuity Income

Mortgage/Contract

Payments

Yes No

Yes No

Yes No

Social Security Benefits

Winnings (Lottery/Gambling)

Child Support/Alimony

Yes No

Yes No

Yes No

Interest on financial accounts

Gifts/loans/contributions

BIA/Tribal Assistance

Yes No

Yes No

Yes No

Disability Insurance

Payments from a trust

Royalties/Dividends

Yes No

Yes No

Yes No

Cash Assistance

Unemployment Insurance

Tips or Commissions

Yes No

Yes No

Yes No

Pensions

Student Grants / Scholarships/Loans

Earned Income Tax Credit

(EITC)

Yes No

Yes No

Yes No

Railroad Retirement

Payments for Room/Board

Other:

For each item marked YES, provide all of the information requested below. If you need more room, attach a separate piece of paper containing the

requested information. SEND CURRENT VERIFICATION OF ALL INCOME LISTED (FOR EXAMPLE, CHECK STUBS, AWARD LETTERS, THE MOST

RECENT INCOME TAX FORMS, IF SELF EMPLOYED). COPIES ARE ACCEPTABLE.

Name of Person Receiving

Date received or expected to

How often received?

Type of Income

Gross Amount (before

the Income

be received

(weekly, bi-weekly, etc.)

deductions)

DE-103 (Rev. 10/2016)

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10