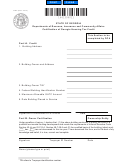

Form It-Hc - Certification Of Georgia Housing Tax Credit - Departments Of Revenue, Insurance And Community Affairs Page 2

ADVERTISEMENT

IT-HC

(rev. 10/02)

Partners or Members

of Ownership Entity

Part ll. Owner Information

1. Taxpayer Entity

1

2. Taxpayer’s Entity TIN

3. Taxpayer’s Address

4. Partner is a

General Partner

Limited Partner

Limited Liability

Company Member

5. Partner type is an

Individual

Corporation

Partnership

2

6. Taxpayer’s percentage

of Federal Low Income Housing Credit __________%

2

7. Taxpayer’s percentage

of Georgia Housing Tax Credit ________________%

Each partnership or other entity involved in marketing Georgia Housing tax

credits must attach an assignment letter.

Taxpayer or Shareholder

Claiming the Credit

Part III. Instructions:

In the schedule below, each shareholder, partner or member who receives a

proportionate share of the Georgia Housing Tax Credit should list the amount

claimed/earned each year. Then complete the following lines to arrive at the credit to

be claimed on their tax return. This form will be used to show your credits earned and

used and will be filed with shareholders income tax return or insurance premium tax

return.

The letters TIN appear at certain points on this form and mean taxpayer identification

number. The Georgia Housing Tax Credit can only be claimed for buildings placed in

service after January 1, 2001. For the purposes of the Georgia Housing Tax Credit,

transfers of ownership of the credit do not trigger recapture. However, in the case of a

transfer, the Commissioner of the Department of Revenue and/or the Commissioner of

Insurance must be notified. Both the transferor, on the return following the transfer, and

1

TIN refers to Taxpayer identification number

2

Enter percentage if known

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3