Form Gid-207-Pt Oct08 - Georgia Job Tax Credit - Insurance Department

ADVERTISEMENT

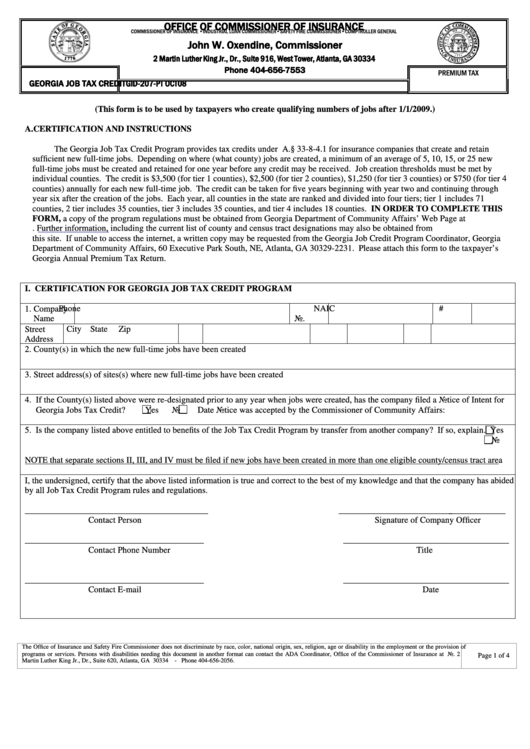

OFFICE OF COMMISSIONER OF INSURANCE

COMMISSIONER OF INSURANCE •INDUSTRIAL LOAN COMMISSIONER•SAFETY FIRE COMMISSIONER•COMPTROLLER GENERAL

John W. Oxendine, Commissioner

2 Martin Luther King Jr., Dr., Suite 916, West Tower, Atlanta, GA 30334

Phone 404-656-7553

PREMIUM TAX

GEORGIA JOB TAX CREDIT

GID-207-PT OCT08

(This form is to be used by taxpayers who create qualifying numbers of jobs after 1/1/2009.)

A. CERTIFICATION AND INSTRUCTIONS

The Georgia Job Tax Credit Program provides tax credits under O.C.G.A.§ 33-8-4.1 for insurance companies that create and retain

sufficient new full-time jobs. Depending on where (what county) jobs are created, a minimum of an average of 5, 10, 15, or 25 new

full-time jobs must be created and retained for one year before any credit may be received. Job creation thresholds must be met by

individual counties. The credit is $3,500 (for tier 1 counties), $2,500 (for tier 2 counties), $1,250 (for tier 3 counties) or $750 (for tier 4

counties) annually for each new full-time job. The credit can be taken for five years beginning with year two and continuing through

year six after the creation of the jobs. Each year, all counties in the state are ranked and divided into four tiers; tier 1 includes 71

counties, 2 tier includes 35 counties, tier 3 includes 35 counties, and tier 4 includes 18 counties. IN ORDER TO COMPLETE THIS

FORM, a copy of the program regulations must be obtained from Georgia Department of Community Affairs’ Web Page at

Further information, including the current list of county and census tract designations may also be obtained from

this site. If unable to access the internet, a written copy may be requested from the Georgia Job Credit Program Coordinator, Georgia

Department of Community Affairs, 60 Executive Park South, NE, Atlanta, GA 30329-2231. Please attach this form to the taxpayer’s

Georgia Annual Premium Tax Return.

I. CERTIFICATION FOR GEORGIA JOB TAX CREDIT PROGRAM

1. Company

Phone

NAIC #

Name

No.

Street

City

State

Zip

Address

2. County(s) in which the new full-time jobs have been created

3. Street address(s) of sites(s) where new full-time jobs have been created

4. If the County(s) listed above were re-designated prior to any year when jobs were created, has the company filed a Notice of Intent for

Georgia Jobs Tax Credit?

Yes

No

Date Notice was accepted by the Commissioner of Community Affairs:

5. Is the company listed above entitled to benefits of the Job Tax Credit Program by transfer from another company? If so, explain.

Yes

No

NOTE that separate sections II, III, and IV must be filed if new jobs have been created in more than one eligible county/census tract area

I, the undersigned, certify that the above listed information is true and correct to the best of my knowledge and that the company has abided

by all Job Tax Credit Program rules and regulations.

__________________________________________

_______________________________________

Contact Person

Signature of Company Officer

_________________________________________

______________________________________

Contact Phone Number

Title

_________________________________________

______________________________________

Contact E-mail

Date

The Office of Insurance and Safety Fire Commissioner does not discriminate by race, color, national origin, sex, religion, age or disability in the employment or the provision of

programs or services. Persons with disabilities needing this document in another format can contact the ADA Coordinator, Office of the Commissioner of Insurance at No. 2

Page 1 of 4

Martin Luther King Jr., Dr., Suite 620, Atlanta, GA 30334 - Phone 404-656-2056.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4