State Of Arkansas Partnership Income Tax Instructions

ADVERTISEMENT

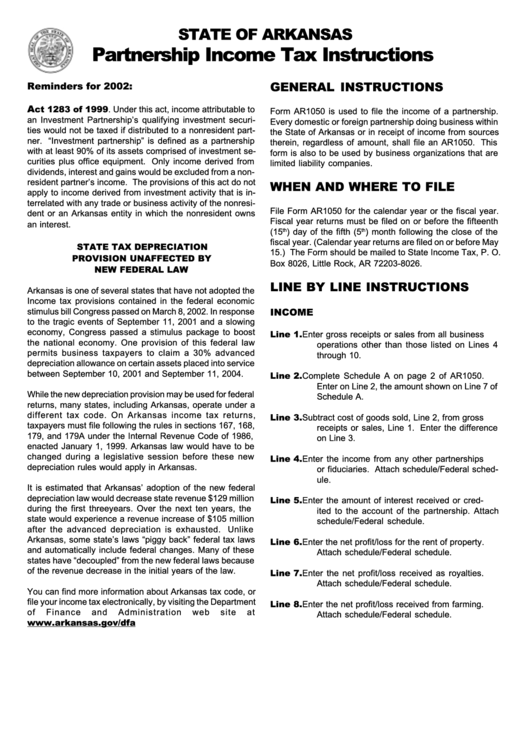

STATE OF ARKANSAS

Partnership Income Tax Instructions

GENERAL INSTRUCTIONS

Reminders for 2002:

A

ct 1283 of 1999. Under this act, income attributable to

Form AR1050 is used to file the income of a partnership.

an Investment Partnership’s qualifying investment securi-

Every domestic or foreign partnership doing business within

ties would not be taxed if distributed to a nonresident part-

the State of Arkansas or in receipt of income from sources

ner. “Investment partnership” is defined as a partnership

therein, regardless of amount, shall file an AR1050. This

with at least 90% of its assets comprised of investment se-

form is also to be used by business organizations that are

curities plus office equipment. Only income derived from

limited liability companies.

dividends, interest and gains would be excluded from a non-

resident partner’s income. The provisions of this act do not

WHEN AND WHERE TO FILE

apply to income derived from investment activity that is in-

terrelated with any trade or business activity of the nonresi-

File Form AR1050 for the calendar year or the fiscal year.

dent or an Arkansas entity in which the nonresident owns

Fiscal year returns must be filed on or before the fifteenth

an interest.

(15

) day of the fifth (5

) month following the close of the

th

th

fiscal year. (Calendar year returns are filed on or before May

STATE TAX DEPRECIATION

15.) The Form should be mailed to State Income Tax, P. O.

PROVISION UNAFFECTED BY

Box 8026, Little Rock, AR 72203-8026.

NEW FEDERAL LAW

LINE BY LINE INSTRUCTIONS

Arkansas is one of several states that have not adopted the

Income tax provisions contained in the federal economic

INCOME

stimulus bill Congress passed on March 8, 2002. In response

to the tragic events of September 11, 2001 and a slowing

economy, Congress passed a stimulus package to boost

Line 1.

Enter gross receipts or sales from all business

the national economy. One provision of this federal law

operations other than those listed on Lines 4

permits business taxpayers to claim a 30% advanced

through 10.

depreciation allowance on certain assets placed into service

between September 10, 2001 and September 11, 2004.

Line 2.

Complete Schedule A on page 2 of AR1050.

Enter on Line 2, the amount shown on Line 7 of

While the new depreciation provision may be used for federal

Schedule A.

returns, many states, including Arkansas, operate under a

different tax code. On Arkansas income tax returns,

Line 3.

Subtract cost of goods sold, Line 2, from gross

taxpayers must file following the rules in sections 167, 168,

receipts or sales, Line 1. Enter the difference

179, and 179A under the Internal Revenue Code of 1986,

on Line 3.

enacted January 1, 1999. Arkansas law would have to be

changed during a legislative session before these new

Line 4.

Enter the income from any other partnerships

depreciation rules would apply in Arkansas.

or fiduciaries. Attach schedule/Federal sched-

ule.

It is estimated that Arkansas’ adoption of the new federal

depreciation law would decrease state revenue $129 million

Line 5.

Enter the amount of interest received or cred-

during the first three years. Over the next ten years, the

ited to the account of the partnership. Attach

state would experience a revenue increase of $105 million

schedule/Federal schedule.

after the advanced depreciation is exhausted. Unlike

Arkansas, some state’s laws “piggy back” federal tax laws

Line 6.

Enter the net profit/loss for the rent of property.

and automatically include federal changes. Many of these

Attach schedule/Federal schedule.

states have “decoupled” from the new federal laws because

of the revenue decrease in the initial years of the law.

Line 7.

Enter the net profit/loss received as royalties.

Attach schedule/Federal schedule.

You can find more information about Arkansas tax code, or

file your income tax electronically, by visiting the Department

Line 8.

Enter the net profit/loss received from farming.

of

Finance

and

Administration

web

site

at

Attach schedule/Federal schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2