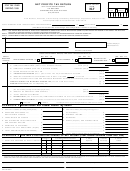

Net Profit Tax Return Form - City Of Parma Heights - 2011 Page 2

ADVERTISEMENT

Page 2

GENERAL TAX INFORMATION - MUST BE COMPLETED

1. Date Business or Trust Created _________________________

6. If business terminated, complete the following; Date terminated

2. Did you file a Parma Heights return last year? ____ Yes ____ No.

3. Did you have any employees during 2011? ____ Yes ____ No. If yes, did

7. If you sold your business, give name and address of purchaser.

they work in Parma Heights? ____ Yes ____ No.

Name

4. On which basis are your records kept? ____ Cash ____ Accrual

Address

____ Completed Contract ____ Other _____________________________

8. If Business Entity changed during past year, mark appropriate blocks:

5. Has your Federal Tax liability for any prior year been changed in the year

From:

_____ Individual

_____ Partnership

_____ Corporation

covered by this return as a result of an examination by the Internal Revenue

To:

_____ Individual

_____ Partnership

_____ Corporation

Service? ____ Yes ____ No.

SCHEDULE X ADJUSTMENTS

Ohio’s Municipal Income Tax Reform, (House Bill 95) created a Uniform Net Profits Base. For taxable years beginning after 2003, be sure returns comply with Ohio

Revised Code 718.01. Excluding Schedule C, E, and F filers, taxable income shall be computed as if the taxpayer is a C Corporation. Include all supporting

schedules, forms and statements to support your income calculation.

ITEMS NOT DEDUCTIBLE – ADD

ITEMS NOT TAXABLE – DEDUCT

I. Capital Gains – Section 1221 or 1231 ............................ $

A. Capital losses – Section 1221 or 1231 .......................... $

B. 5% of Line K – (Intangible Income) ................................

J. Intangible Income

C. Taxes based on Income ..................................................

Interest Income

D. REIT – other Investor Benefits (See Instr.) ....................

Dividends

E. Guaranteed Payments to Partners ..................................

Royalties

F. Self-employed/owner expenses (See Instr.)....................

Other

G. Other (Depreciation Recovery Note: Business entities

K. Total Intangible Income ..................................................

that are not C corporations, but are required to file as a

L. Other Deductions (See Instr.)..........................................

C corporation, are subject to Section 291 depreciation

recovery of Section 1250 property.)

EXPLAIN: ____________________________________

M. Other (explain)

H. TOTAL ADDITIONS (enter Line 2A, Page 1) .................. $

Z. TOTAL DEDUCTIONS (enter Line 2B, Page 1) .............. $

SCHEDULE Y BUSINESS APPORTIONMENT FORMULA

a. LOCATED

b. LOCATED IN

PERCENTAGE

EVERYWHERE

PARMA HEIGHTS

[(b) Divided (a)]

STEP 1. AVG. ORIGINAL COST OF REAL & TANG. PERSONAL PROPERTY

$ _______________

$ _______________

GROSS ANNUAL RENTALS PAID MULTIPLIED BY 8

$ _______________

$ _______________

TOTAL STEP 1

$ _______________

$ _______________

_______________ %

STEP 2. GROSS RECEIPTS FROM SALES MADE AND/OR WORK

OR SERVICES PERFORMED (SEE INSTRUCTIONS)

$ _______________

$ _______________

_______________ %

STEP 3. WAGES, SALARIES, AND OTHER COMPENSATION PAID

$ _______________

$ _______________

_______________ %

STEP 4. TOTAL PERCENTAGES

_______________ %

STEP 5. AVERAGE PERCENTAGE (Divide Total Percentages

by Number of Percentages Used)

Carry to Page 1, Line 4 ______________ %

Are there any employees leased in the year covered by this return? __________ Yes

__________ No

If Yes, please provide the name, address and FID number of the leasing company.

Name: _____________________________________________________________________________________________________________________________

Address:____________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

FID Number: ________________________________________________________________________________________________________________________

S:3936

S:3936

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2