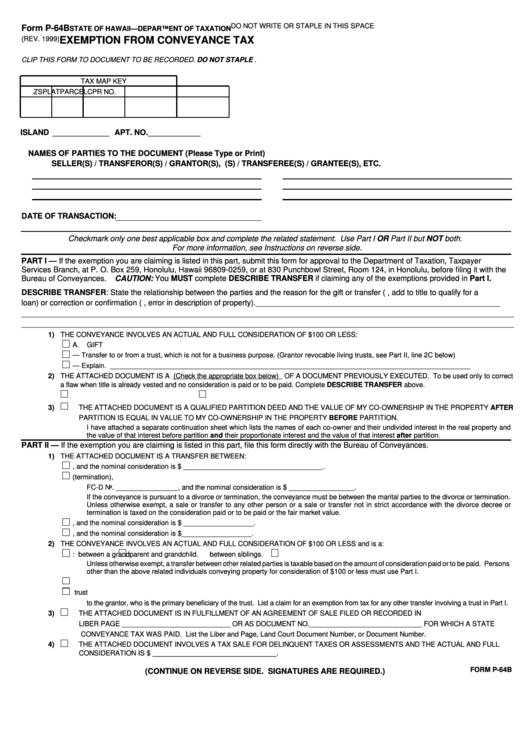

DO NOT WRITE OR STAPLE IN THIS SPACE

Form P-64B

STATE OF HAWAII—DEPARTMENT OF TAXATION

(REV. 1999)

EXEMPTION FROM CONVEYANCE TAX

CLIP THIS FORM TO DOCUMENT TO BE RECORDED. DO NOT STAPLE .

TAX MAP KEY

Z

S

PLAT

PARCEL

CPR NO.

ISLAND _____________ APT. NO. ____________

NAMES OF PARTIES TO THE DOCUMENT (Please Type or Print)

SELLER(S) / TRANSFEROR(S) / GRANTOR(S), ETC.

PURCHASER(S) / TRANSFEREE(S) / GRANTEE(S), ETC.

DATE OF TRANSACTION:

Checkmark only one best applicable box and complete the related statement. Use Part I OR Part II but NOT both.

For more information, see Instructions on reverse side.

PART I — If the exemption you are claiming is listed in this part, submit this form for approval to the Department of Taxation, Taxpayer

Services Branch, at P. O. Box 259, Honolulu, Hawaii 96809-0259, or at 830 Punchbowl Street, Room 124, in Honolulu, before filing it with the

Bureau of Conveyances. CAUTION: You MUST complete DESCRIBE TRANSFER if claiming any of the exemptions provided in Part I.

DESCRIBE TRANSFER: State the relationship between the parties and the reason for the gift or transfer (e.g., add to title to qualify for a

loan) or correction or confirmation (e.g., error in description of property). ________________________________________________________

_________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

1) THE CONVEYANCE INVOLVES AN ACTUAL AND FULL CONSIDERATION OF $100 OR LESS:

A.

GIFT

B.

TRUST — Transfer to or from a trust, which is not for a business purpose. (Grantor revocable living trusts, see Part II, line 2C below)

C.

OTHER — Explain. _____________________________________________________________________________________________

2) THE ATTACHED DOCUMENT IS A (Check the appropriate box below) OF A DOCUMENT PREVIOUSLY EXECUTED. To be used only to correct

a flaw when title is already vested and no consideration is paid or to be paid. Complete DESCRIBE TRANSFER above.

A.

Confirmation document.

B. Correction deed.

3)

THE ATTACHED DOCUMENT IS A QUALIFIED PARTITION DEED AND THE VALUE OF MY CO-OWNERSHIP IN THE PROPERTY AFTER

PARTITION IS EQUAL IN VALUE TO MY CO-OWNERSHIP IN THE PROPERTY BEFORE PARTITION.

I have attached a separate continuation sheet which lists the names of each co-owner and their undivided interest in the real property and

the value of that interest before partition and their proportionate interest and the value of that interest after partition.

PART II — If the exemption you are claiming is listed in this part, file this form directly with the Bureau of Conveyances.

1) THE ATTACHED DOCUMENT IS A TRANSFER BETWEEN:

A.

HUSBAND AND WIFE, and the nominal consideration is $ ____________________________________.

B.

MARITAL PARTIES in accordance with divorce decree or termination of reciprocal beneficiary relationship (termination),

FC-D No. ________________, and the nominal consideration is $ _________________.

If the conveyance is pursuant to a divorce or termination, the conveyance must be between the marital parties to the divorce or termination.

Unless otherwise exempt, a sale or transfer to any other person or a sale or transfer not in strict accordance with the divorce decree or

termination is taxed on the consideration paid or to be paid or the fair market value.

C.

RECIPROCAL BENEFICIARIES, and the nominal consideration is $ __________________.

D.

PARENT AND CHILD, and the nominal consideration is $__________________.

2) THE CONVEYANCE INVOLVES AN ACTUAL AND FULL CONSIDERATION OF $100 OR LESS and is a:

A.

GIFT:

between a grandparent and grandchild.

between siblings.

Unless otherwise exempt, a transfer between other related parties is taxable based on the amount of consideration paid or to be paid. Persons

other than the above related individuals conveying property for consideration of $100 or less must use Part I.

B.

TESTAMENTARY GIFT BY TRUST - Transfer from a grantor to a testamentary trust or from a testamentary trust to a third party beneficiary.

C.

GRANTOR REVOCABLE LIVING TRUST - Transfer by a grantor to a grantor revocable living trust or from a grantor revocable living trust

to the grantor, who is the primary beneficiary of the trust. List a claim for an exemption from tax for any other transfer involving a trust in Part I.

3)

THE ATTACHED DOCUMENT IS IN FULFILLMENT OF AN AGREEMENT OF SALE FILED OR RECORDED IN

LIBER PAGE ____________________________ OR AS DOCUMENT NO._____________________________ FOR WHICH A STATE

CONVEYANCE TAX WAS PAID. List the Liber and Page, Land Court Document Number, or Document Number.

4)

THE ATTACHED DOCUMENT INVOLVES A TAX SALE FOR DELINQUENT TAXES OR ASSESSMENTS AND THE ACTUAL AND FULL

CONSIDERATION IS $ ________________________________.

FORM P-64B

(CONTINUE ON REVERSE SIDE. SIGNATURES ARE REQUIRED.)

1

1 2

2