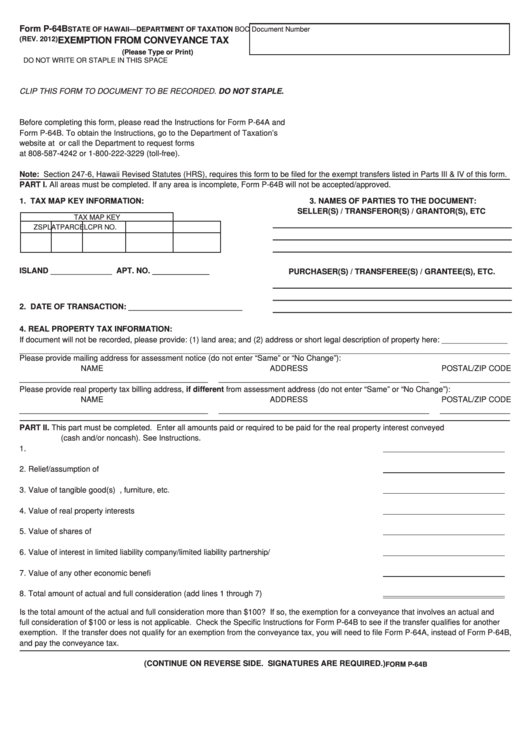

Form P-64B

STATE OF HAWAII—DEPARTMENT OF TAXATION

BOC Document Number

(REV. 2012)

EXEMPTION FROM CONVEYANCE TAX

(Please Type or Print)

DO NOT WRITE OR STAPLE IN THIS SPACE

CLIP THIS FORM TO DOCUMENT TO BE RECORDED. DO NOT STAPLE.

Before completing this form, please read the Instructions for Form P-64A and

Form P-64B. To obtain the Instructions, go to the Department of Taxation’s

website at or call the Department to request forms

at 808-587-4242 or 1-800-222-3229 (toll-free).

Note: Section 247-6, Hawaii Revised Statutes (HRS), requires this form to be filed for the exempt transfers listed in Parts III & IV of this form.

PART I. All areas must be completed. If any area is incomplete, Form P-64B will not be accepted/approved.

1. TAX MAP KEY INFORMATION:

3. NAMES OF PARTIES TO THE DOCUMENT:

SELLER(S) / TRANSFEROR(S) / GRANTOR(S), ETC

TAX MAP KEY

___________________________________

Z

S

PLAT

PARCEL

CPR NO.

___________________________________

___________________________________

ISLAND ______________ APT. NO. _____________

PURCHASER(S) / TRANSFEREE(S) / GRANTEE(S), ETC.

___________________________________

___________________________________

___________________________________

2. DATE OF TRANSACTION: __________________________

4. REAL PROPERTY TAX INFORMATION:

If document will not be recorded, please provide: (1) land area; and (2) address or short legal description of property here: _______________

________________________________________________________________________________________________________________

Please provide mailing address for assessment notice (do not enter “Same” or “No Change”):

NAME

ADDRESS

POSTAL/ZIP CODE

___________________________________________

________________________________________________

________________

Please provide real property tax billing address, if different from assessment address (do not enter “Same” or “No Change”):

NAME

ADDRESS

POSTAL/ZIP CODE

___________________________________________

________________________________________________

________________

PART II.

This part must be completed. Enter all amounts paid or required to be paid for the real property interest conveyed

(cash and/or noncash). See Instructions.

1. Cash...........................................................................................................................................................

2. Relief/assumption of debt...........................................................................................................................

3. Value of tangible good(s) e.g. equipment, furniture, etc. ............................................................................

4. Value of real property interests exchanged.................................................................................................

5. Value of shares of stock..............................................................................................................................

6. Value of interest in limited liability company/limited liability partnership/partnership..................................

7. Value of any other economic benefit...........................................................................................................

8. Total amount of actual and full consideration (add lines 1 through 7).........................................................

Is the total amount of the actual and full consideration more than $100? If so, the exemption for a conveyance that involves an actual and

full consideration of $100 or less is not applicable. Check the Specific Instructions for Form P-64B to see if the transfer qualifies for another

exemption. If the transfer does not qualify for an exemption from the conveyance tax, you will need to file Form P-64A, instead of Form P-64B,

and pay the conveyance tax.

(CONTINUE ON REVERSE SIDE. SIGNATURES ARE REQUIRED.)

FORM P-64B

1

1 2

2