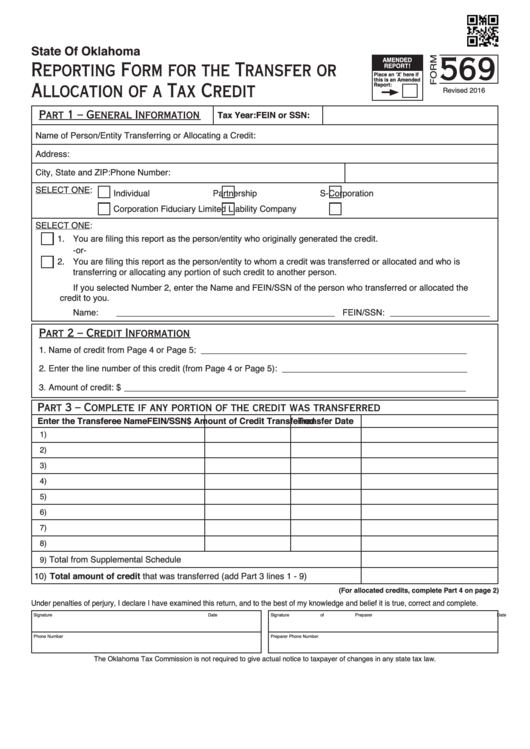

State Of Oklahoma

569

AMENDED

Reporting Form for the Transfer or

REPORT!

Place an ‘X’ here if

this is an Amended

Allocation of a Tax Credit

Report:

Revised 2016

Part 1 – General Information

Tax Year:

FEIN or SSN:

Name of Person/Entity Transferring or Allocating a Credit:

Address:

City, State and ZIP:

Phone Number:

SELECT ONE:

Individual

Partnership

S-Corporation

Corporation

Fiduciary

Limited Liability Company

SELECT ONE:

1. You are filing this report as the person/entity who originally generated the credit.

-or-

2. You are filing this report as the person/entity to whom a credit was transferred or allocated and who is

transferring or allocating any portion of such credit to another person.

If you selected Number 2, enter the Name and FEIN/SSN of the person who transferred or allocated the

credit to you.

Name: ______________________________________________ FEIN/SSN: _____________________

Part 2 – Credit Information

1. Name of credit from Page 4 or Page 5: ________________________________________________________

2. Enter the line number of this credit (from Page 4 or Page 5): _______________________________________

3. Amount of credit: $ ________________________________________________________________________

Part 3 – Complete if any portion of the credit was transferred

Enter the Transferee Name

FEIN/SSN

Transfer Date

$ Amount of Credit Transferred

1)

2)

3)

4)

5)

6)

7)

8)

Total from Supplemental Schedule

9)

10) Total amount of credit that was transferred (add Part 3 lines 1 - 9)

(For allocated credits, complete Part 4 on page 2)

Under penalties of perjury, I declare I have examined this return, and to the best of my knowledge and belief it is true, correct and complete.

Signature

Date

Signature of Preparer

Date

Phone Number

Preparer Phone Number

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

1

1 2

2 3

3 4

4 5

5