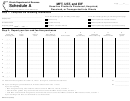

860306

Schedule A (Form 940) for 2006:

OMB No. 1545-0028

Multi-State Employer and Credit Reduction Information

Department of the Treasury — Internal Revenue Service

—

Employer identification number (EIN)

Name (not your trade name)

About this schedule:

You must fill out Schedule A (Form 940) if you were required to pay your state unemployment tax in more than one state or if you paid

wages in any state that is subject to credit reduction. FOR 2006, THERE ARE NO STATES SUBJECT TO CREDIT REDUCTION.

File Schedule A (Form 940) as an attachment to your Form 940.

For more information, read the Instructions for Schedule A (Form 940) on the back.

Part 1: Fill out this part if you were required to pay state unemployment taxes in more than one state (including the

District of Columbia, Puerto Rico, and the U.S. Virgin Islands). If any states do NOT apply to you, leave them

blank.

1

Check the box for every state in which you were required to pay state unemployment tax this year. For a list of state names and

their abbreviations, see the Instructions for Schedule A (Form 940).

AK

CO

GA

IN

MD

MS

NH

OH

SC

VA

WY

AL

CT

HI

KS

MI

MT

NJ

OK

SD

VT

PR

AR

DC

IA

KY

MN

NC

NM

OR

TN

WA

VI

AZ

DE

ID

LA

MO

ND

NV

PA

TX

WI

CA

FL

IL

MA

ME

NE

NY

RI

UT

WV

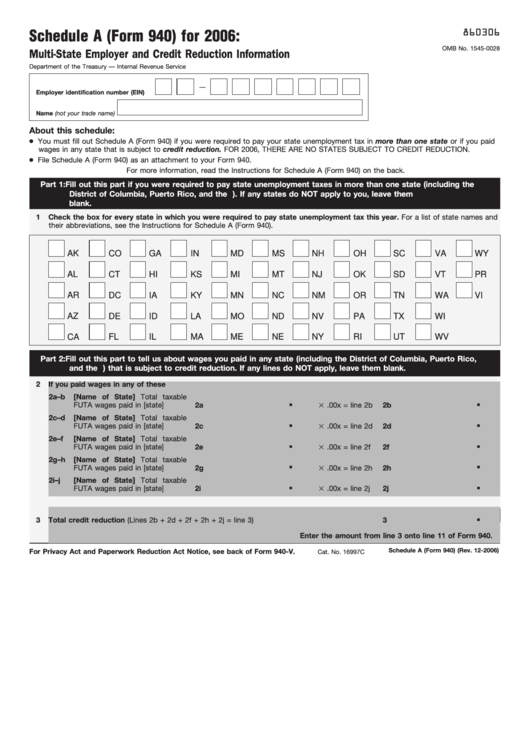

Part 2: Fill out this part to tell us about wages you paid in any state (including the District of Columbia, Puerto Rico,

and the U.S. Virgin Islands) that is subject to credit reduction. If any lines do NOT apply, leave them blank.

2

If you paid wages in any of these states...

.

.

2a–b

[Name of State] Total taxable

FUTA wages paid in [state]

2a

.00x = line 2b

2b

.

.

2c–d

[Name of State] Total taxable

FUTA wages paid in [state]

2c

.00x = line 2d

2d

.

.

2e–f

[Name of State] Total taxable

FUTA wages paid in [state]

2e

.00x = line 2f

2f

.

.

2g–h

[Name of State] Total taxable

FUTA wages paid in [state]

2g

.00x = line 2h

2h

.

.

2i–j

[Name of State] Total taxable

FUTA wages paid in [state]

2i

.00x = line 2j

2j

.

3

Total credit reduction (Lines 2b + 2d + 2f + 2h + 2j = line 3)

3

Enter the amount from line 3 onto line 11 of Form 940.

Schedule A (Form 940) (Rev. 12-2006)

For Privacy Act and Paperwork Reduction Act Notice, see back of Form 940-V.

Cat. No. 16997C

1

1 2

2