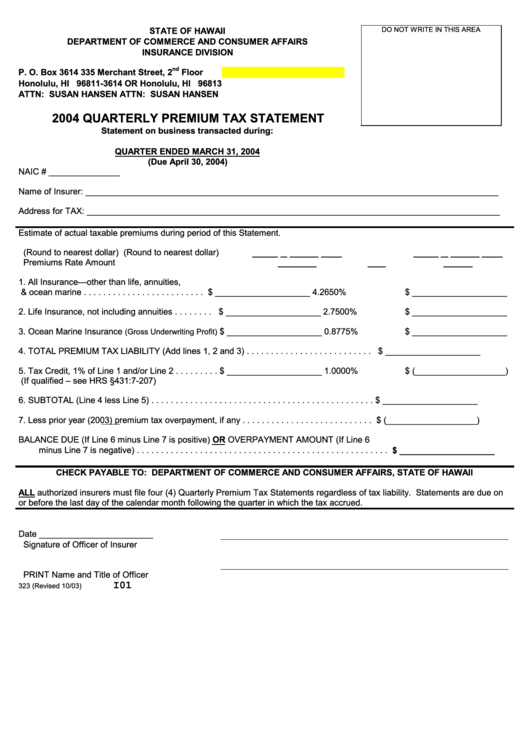

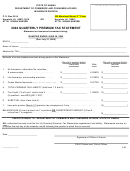

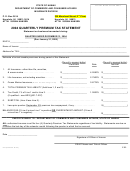

Form 323 - Quarterly Premium Tax Statement - 2004

ADVERTISEMENT

DO NOT WRITE IN THIS AREA

STATE OF HAWAII

DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS

INSURANCE DIVISION

nd

P. O. Box 3614

335 Merchant Street, 2

Floor

Honolulu, HI 96811-3614

OR

Honolulu, HI 96813

ATTN: SUSAN HANSEN

ATTN: SUSAN HANSEN

2004 QUARTERLY PREMIUM TAX STATEMENT

Statement on business transacted during:

QUARTER ENDED MARCH 31, 2004

(Due April 30, 2004)

NAIC # _______________

Name of Insurer: _______________________________________________________________________________________

Address for TAX: _______________________________________________________________________________________

Estimate of actual taxable premiums during period of this Statement.

(Round to nearest dollar)

(Round to nearest dollar)

Premiums

Rate

Amount

1.

All Insurance---other than life, annuities,

& ocean marine . . . . . . . . . . . . . . . . . . . . . . . . .

$ ____________________

4.2650%

$ ____________________

2.

Life Insurance, not including annuities . . . . . . . .

$ ____________________

2.7500%

$ ____________________

3.

Ocean Marine Insurance

$ ____________________

0.8775%

$ ____________________

(Gross Underwriting Profit)

4.

TOTAL PREMIUM TAX LIABILITY (Add lines 1, 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ____________________

5.

Tax Credit, 1% of Line 1 and/or Line 2 . . . . . . . . .

$ ____________________

1.0000%

$ (___________________)

(If qualified – see HRS §431:7-207)

6.

SUBTOTAL (Line 4 less Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ____________________

7.

Less prior year (2003) premium tax overpayment, if any . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ (___________________)

BALANCE DUE (If Line 6 minus Line 7 is positive) OR OVERPAYMENT AMOUNT (If Line 6

minus Line 7 is negative) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ____________________

CHECK PAYABLE TO: DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS, STATE OF HAWAII

ALL authorized insurers must file four (4) Quarterly Premium Tax Statements regardless of tax liability. Statements are due on

or before the last day of the calendar month following the quarter in which the tax accrued.

Date ________________________

Signature of Officer of Insurer

PRINT Name and Title of Officer

I01

323 (Revised 10/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4