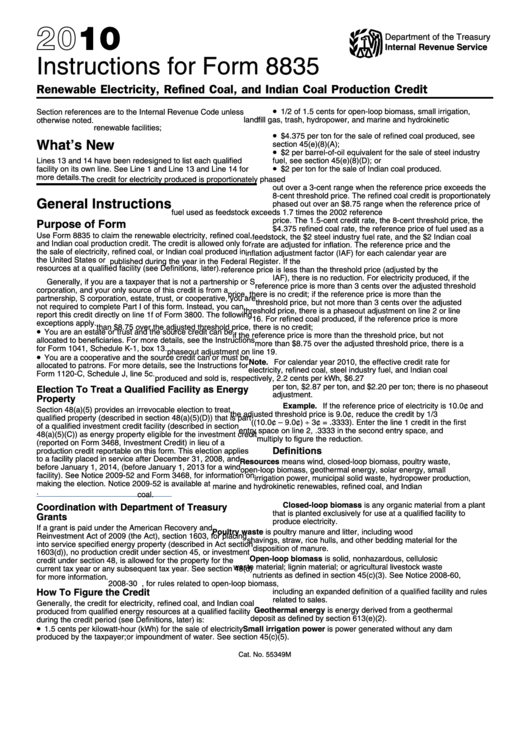

Instructions For Form 8835 - Renewable Electricity, Refined Coal, And Indian Coal Production Credit - 2010

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 8835

Renewable Electricity, Refined Coal, and Indian Coal Production Credit

•

1/2 of 1.5 cents for open-loop biomass, small irrigation,

Section references are to the Internal Revenue Code unless

landfill gas, trash, hydropower, and marine and hydrokinetic

otherwise noted.

renewable facilities;

•

$4.375 per ton for the sale of refined coal produced, see

What’s New

section 45(e)(8)(A);

•

$2 per barrel-of-oil equivalent for the sale of steel industry

fuel, see section 45(e)(8)(D); or

Lines 13 and 14 have been redesigned to list each qualified

•

$2 per ton for the sale of Indian coal produced.

facility on its own line. See Line 1 and Line 13 and Line 14 for

more details.

The credit for electricity produced is proportionately phased

out over a 3-cent range when the reference price exceeds the

8-cent threshold price. The refined coal credit is proportionately

General Instructions

phased out over an $8.75 range when the reference price of

fuel used as feedstock exceeds 1.7 times the 2002 reference

price. The 1.5-cent credit rate, the 8-cent threshold price, the

Purpose of Form

$4.375 refined coal rate, the reference price of fuel used as a

Use Form 8835 to claim the renewable electricity, refined coal,

feedstock, the $2 steel industry fuel rate, and the $2 Indian coal

and Indian coal production credit. The credit is allowed only for

rate are adjusted for inflation. The reference price and the

the sale of electricity, refined coal, or Indian coal produced in

inflation adjustment factor (IAF) for each calendar year are

the United States or U.S. possessions from qualified energy

published during the year in the Federal Register. If the

resources at a qualified facility (see Definitions, later).

reference price is less than the threshold price (adjusted by the

IAF), there is no reduction. For electricity produced, if the

Generally, if you are a taxpayer that is not a partnership or S

reference price is more than 3 cents over the adjusted threshold

corporation, and your only source of this credit is from a

price, there is no credit; if the reference price is more than the

partnership, S corporation, estate, trust, or cooperative, you are

threshold price, but not more than 3 cents over the adjusted

not required to complete Part I of this form. Instead, you can

threshold price, there is a phaseout adjustment on line 2 or line

report this credit directly on line 1f of Form 3800. The following

16. For refined coal produced, if the reference price is more

exceptions apply.

than $8.75 over the adjusted threshold price, there is no credit;

•

You are an estate or trust and the source credit can be

if the reference price is more than the threshold price, but not

allocated to beneficiaries. For more details, see the Instructions

more than $8.75 over the adjusted threshold price, there is a

for Form 1041, Schedule K-1, box 13.

phaseout adjustment on line 19.

•

You are a cooperative and the source credit can or must be

Note. For calendar year 2010, the effective credit rate for

allocated to patrons. For more details, see the Instructions for

electricity, refined coal, steel industry fuel, and Indian coal

Form 1120-C, Schedule J, line 5c.

produced and sold is, respectively, 2.2 cents per kWh, $6.27

per ton, $2.87 per ton, and $2.20 per ton; there is no phaseout

Election To Treat a Qualified Facility as Energy

adjustment.

Property

Example. If the reference price of electricity is 10.0¢ and

Section 48(a)(5) provides an irrevocable election to treat

the adjusted threshold price is 9.0¢, reduce the credit by 1/3

qualified property (described in section 48(a)(5)(D)) that is part

((10.0¢ – 9.0¢) ÷ 3¢ = .3333). Enter the line 1 credit in the first

of a qualified investment credit facility (described in section

entry space on line 2, .3333 in the second entry space, and

48(a)(5)(C)) as energy property eligible for the investment credit

multiply to figure the reduction.

(reported on Form 3468, Investment Credit) in lieu of a

Definitions

production credit reportable on this form. This election applies

to a facility placed in service after December 31, 2008, and

Resources means wind, closed-loop biomass, poultry waste,

before January 1, 2014, (before January 1, 2013 for a wind

open-loop biomass, geothermal energy, solar energy, small

facility). See Notice 2009-52 and Form 3468, for information on

irrigation power, municipal solid waste, hydropower production,

making the election. Notice 2009-52 is available at

marine and hydrokinetic renewables, refined coal, and Indian

coal.

Closed-loop biomass is any organic material from a plant

Coordination with Department of Treasury

that is planted exclusively for use at a qualified facility to

Grants

produce electricity.

If a grant is paid under the American Recovery and

Poultry waste is poultry manure and litter, including wood

Reinvestment Act of 2009 (the Act), section 1603, for placing

shavings, straw, rice hulls, and other bedding material for the

into service specified energy property (described in Act section

disposition of manure.

1603(d)), no production credit under section 45, or investment

Open-loop biomass is solid, nonhazardous, cellulosic

credit under section 48, is allowed for the property for the

waste material; lignin material; or agricultural livestock waste

current tax year or any subsequent tax year. See section 48(d)

nutrients as defined in section 45(c)(3). See Notice 2008-60,

for more information.

2008-30 I.R.B. 178, for rules related to open-loop biomass,

How To Figure the Credit

including an expanded definition of a qualified facility and rules

related to sales.

Generally, the credit for electricity, refined coal, and Indian coal

Geothermal energy is energy derived from a geothermal

produced from qualified energy resources at a qualified facility

deposit as defined by section 613(e)(2).

during the credit period (see Definitions, later) is:

•

Small irrigation power is power generated without any dam

1.5 cents per kilowatt-hour (kWh) for the sale of electricity

produced by the taxpayer;

or impoundment of water. See section 45(c)(5).

Cat. No. 55349M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4