Form Hp 1040 - Individual Income Tax Return - City Of Highland Park - 2004 Page 2

ADVERTISEMENT

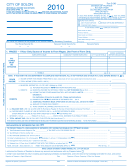

HP 1040

2 2 0 0

04

SCHEDULE 1 R

– RESIDENTS (see instructions)

Attach schedules to support all entries

ADDITIONS

A.

A.

Other – explain and attach schedules ..................................................................................................................

TO

INCOME

B.

B.

Total Additions – enter here and on page 1, line 2 ...............................................................................................

C.

C.

Interest on U.S. and State obligations (attach W-2P, or SSA-1099) ....................................................................

D.

D.

Annuities, pensions, and insurance proceeds (attach W-2P, or SSA-1099) ........................................................

SUBTRACTIONS

(Including Social Security)

E.

FROM

E.

Compensation from services in U.S. Armed Forces.............................................................................................

INCOME

F.

F.

IRA payments – attach receipt from financial institution .......................................................................................

IF INCLUDED

G.

IN

G.

Unemployment benefits including SUB pay..........................................................................................................

GROSS

H.

H.

Moving expense (attach copy of Federal Form 3903) ..........................................................................................

I.

I.

Other – explain and attach schedules ..................................................................................................................

J.

J.

Total subtractions – enter here and on page 1, line 4 ..........................................................................................

SCHEDULE 1 NR

NON-RESIDENTS ONLY

COMPUTATION OF WAGES EARNED IN HIGHLAND PARK – To be completed by Non-

Residents who performed only part of their services in Highland Park and part outside city on same job. Where both husband and

wife have income subject to allocation, figure them separately. (Attach list indicating dates and other locations where work was per-

formed – from supplement).

A.

261

A.

Total Work Days...........................................................................................................................................................................................................

Days

B.

B.

Actual number of days worked outside Highland Park (Attach Statement)..................................................................................................................

Days

C.

C.

Percent of days worked outside Highland Park to Total days (line B divided by line A) ROUND TO TWO DIGITS ONLY .........................................

%

D.

$

D.

Gross Wages shown on W-2 or HPW-2.......................................................................................................................................................................

E.

$

E.

Line D Multiplied by Percentage on Line C ..................................................................................................................................................................

(Those keeping separate records of Highland Park Earnings enter amount of Line E and attach list.

F.

$

F.

Line D Minus Line E .....................................................................................................................................................................................................

G.

$

G.

Add all other W-2 or HPW-2 income not allocated.......................................................................................................................................................

H.

H.

TOTAL WAGES – subject to Highland Park City Tax (lines F and G) enter on page 1, line 1B ..................................................................................

SCHEDULE 2 NR

– NON-RESIDENTS (see instructions)

Attach schedules to support all entries

A.

A.

Net profits from Highland Park rental property (attach Schedule E).....................................................................

B.

B.

Net profits from sale of property located in Highland Park ...................................................................................

ADDITIONS

C.

C.

Net profits of a business or profession earned in Highland Park (attach Schedule C or

TO

Schedule E, Part II)...............................................................................................................................................

INCOME

D.

D.

Other – explain and attach schedules ..................................................................................................................

E.

E.

Total Additions – enter here and on page 1, line 2 ...............................................................................................

SUBTRACTIONS

F.

F.

Employees expenses incurred in the production of Highland Park income..........................................................

FROM

(include Federal Form 2106)

G.

G.

IRA payments made on income taxed by The City of Highland Park Only...........................................................

INCOME

(Attach receipt from financial institution)

IF INCLUDED

H.

H.

Other – explain and attach schedules ..................................................................................................................

IN

I.

I.

Total subtractions. Enter here and on page 1, line 4 ............................................................................................

GROSS

(If additional space is needed, show information on separate sheet)

page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4