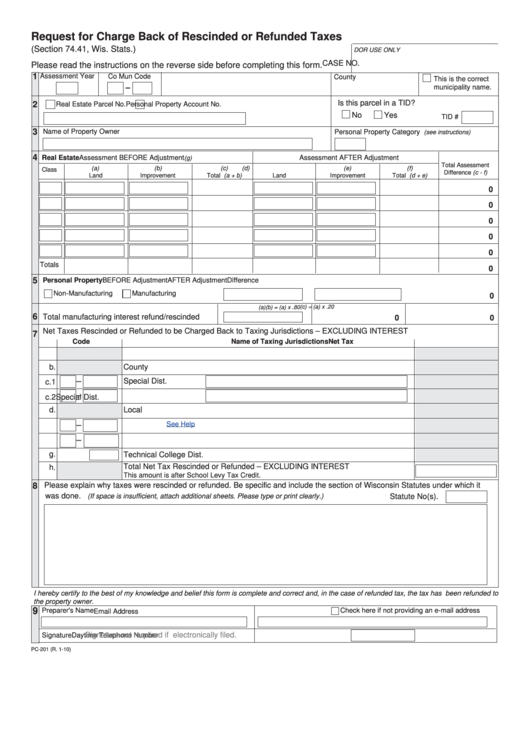

Form Pc-201 - Request For Charge Back Of Rescinded Or Refunded Taxes

ADVERTISEMENT

Request for Charge Back of Rescinded or Refunded Taxes

(Section 74.41, Wis. Stats.)

DOR USE ONLY

CASE NO.

Please read the instructions on the reverse side before completing this form.

1

Assessment Year

Co Mun Code

County

This is the correct

-

municipality name.

Is this parcel in a TID?

2

Real Estate Parcel No.

Personal Property Account No.

No

Yes

TID #

3

Name of Property Owner

Personal Property Category

(see instructions)

4

Real Estate

Assessment BEFORE Adjustment

Assessment AFTER Adjustment

(g)

Total Assessment

(a)

(b)

(c)

(d)

(e)

(f)

Class

Difference (c - f)

Land

Improvement

Total (a + b)

Land

Improvement

Total (d + e)

0

0

0

0

0

Totals

0

5

Personal Property

BEFORE Adjustment

AFTER Adjustment

Difference

Non-Manufacturing

Manufacturing

0

(c) = (a) x .20

(a)

(b) = (a) x .80

6

Total manufacturing interest refund/rescinded

0

0

Net Taxes Rescinded or Refunded to be Charged Back to Taxing Jurisdictions – EXCLUDING INTEREST

7

Code

Name of Taxing Jurisdictions

Net Tax

a.

State of Wisconsin

b.

County

–

Special Dist.

c.1

–

c.2

Special Dist.

d.

Local

e.

School Dist.

See Help

–

–

f.

Union High School Dist.

g.

Technical College Dist.

Total Net Tax Rescinded or Refunded – EXCLUDING INTEREST

h.

This amount is after School Levy Tax Credit.

Please explain why taxes were rescinded or refunded. Be specific and include the section of Wisconsin Statutes under which it

8

was done.

(If space is insufficient, attach additional sheets. Please type or print clearly.)

Statute No(s).

I hereby certify to the best of my knowledge and belief this form is complete and correct and, in the case of refunded tax, the tax has been refunded to

the property owner.

9

Preparer's Name

Check here if not providing an e-mail address

Email Address

Signature not required if electronically filed.

Signature

Daytime Telephone Number

PC-201 (R. 1-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2