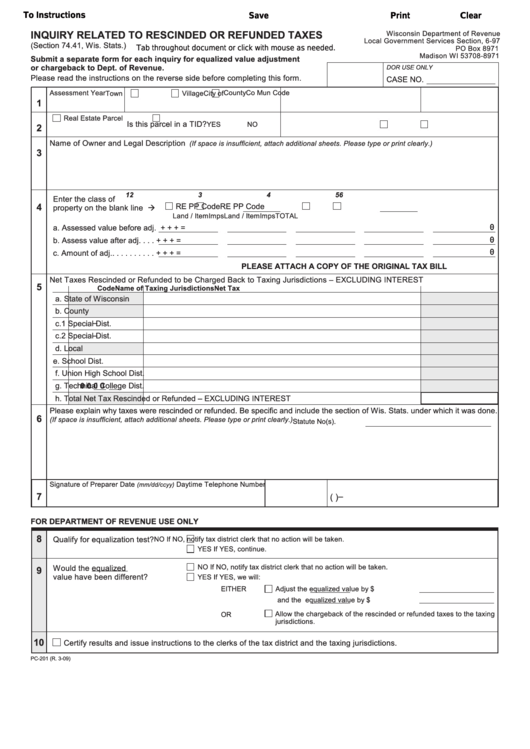

To Instructions

Save

Print

Clear

INQUIRY RELATED TO RESCINDED OR REFUNDED TAXES

Wisconsin Department of Revenue

Local Government Services Section, 6‑97

(Section 74.41, Wis. Stats.)

PO Box 8971

Tab throughout document or click with mouse as needed.

Madison WI 53708‑8971

Submit a separate form for each inquiry for equalized value adjustment

or chargeback to Dept. of Revenue.

DOR USE ONLY

Please read the instructions on the reverse side before completing this form.

CASE NO.

Assessment Year

County

Co Mun Code

Town

Village

City

of

1

Real Estate Parcel No.

Personal Property Account No.

Is this parcel in a TID?

YES

NO

2

Name of Owner and Legal Description

(If space is insufficient, attach additional sheets. Please type or print clearly.)

3

1

2

3

4

5

6

Enter the class of

4

RE

PP Code

RE

PP Code

property on the blank line

Land / Item

Imps

Land / Item

Imps

TOTAL

a. Assessed value before adj.

+

+

+

=

0

b. Assess value after adj. . . .

+

+

+

=

0

c. Amount of adj. . . . . . . . . . .

+

+

+

=

0

PLEASE ATTACH A COPY OF THE ORIGINAL TAX BILL

Net Taxes Rescinded or Refunded to be Charged Back to Taxing Jurisdictions – EXCLUDING INTEREST

5

Code

Name of Taxing Jurisdictions

Net Tax

a.

State of Wisconsin

b.

County

–

c.1

Special Dist.

–

c.2

Special Dist.

d.

Local

e.

School Dist.

f.

Union High School Dist.

g.

0 0

0 0

Technical College Dist.

h.

Total Net Tax Rescinded or Refunded – EXCLUDING INTEREST

Please explain why taxes were rescinded or refunded. Be specific and include the section of Wis. Stats. under which it was done.

6

(If space is insufficient, attach additional sheets. Please type or print clearly.)

Statute No(s).

Signature of Preparer

Date

Daytime Telephone Number

(mm/dd/ccyy)

7

(

)

–

FOR DEPARTMENT OF REVENUE USE ONLY

8

Qualify for equalization test?

NO

If NO, notify tax district clerk that no action will be taken.

YES

If YES, continue.

NO

If NO, notify tax district clerk that no action will be taken.

Would the

equalized

9

value have been different?

YES

If YES, we will:

EITHER

Adjust the

equalized value by $

and the

equalized value by $

Allow the chargeback of the rescinded or refunded taxes to the taxing

OR

jurisdictions.

10

Certify results and issue instructions to the clerks of the tax district and the taxing jurisdictions.

PC‑201 (R. 3‑09)

1

1