Form R-Ez - Tax Return - City Of Dayton

ADVERTISEMENT

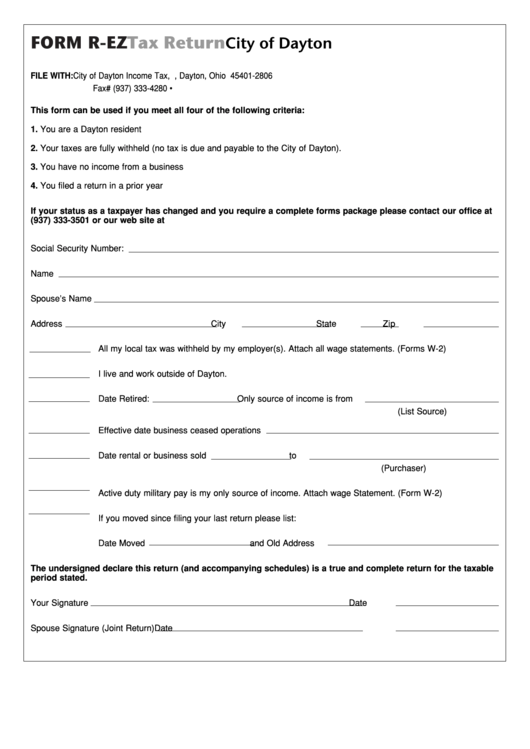

FORM R-EZ

Tax Return

City of Dayton

FILE WITH:

City of Dayton Income Tax, P.O. Box 2806, Dayton, Ohio 45401-2806

Fax# (937) 333-4280 •

This form can be used if you meet all four of the following criteria:

1. You are a Dayton resident

2. Your taxes are fully withheld (no tax is due and payable to the City of Dayton).

3. You have no income from a business

4. You filed a return in a prior year

If your status as a taxpayer has changed and you require a complete forms package please contact our office at

(937) 333-3501 or our web site at .

Social Security Number:

Name

Spouse’s Name

Address

City

State

Zip

All my local tax was withheld by my employer(s). Attach all wage statements. (Forms W-2)

I live and work outside of Dayton.

Date Retired:

Only source of income is from

(List Source)

Effective date business ceased operations

Date rental or business sold

to

(Purchaser)

Active duty military pay is my only source of income. Attach wage Statement. (Form W-2)

If you moved since filing your last return please list:

Date Moved

and Old Address

The undersigned declare this return (and accompanying schedules) is a true and complete return for the taxable

period stated.

Your Signature

Date

Spouse Signature (Joint Return)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1