Reset Form

Print Form

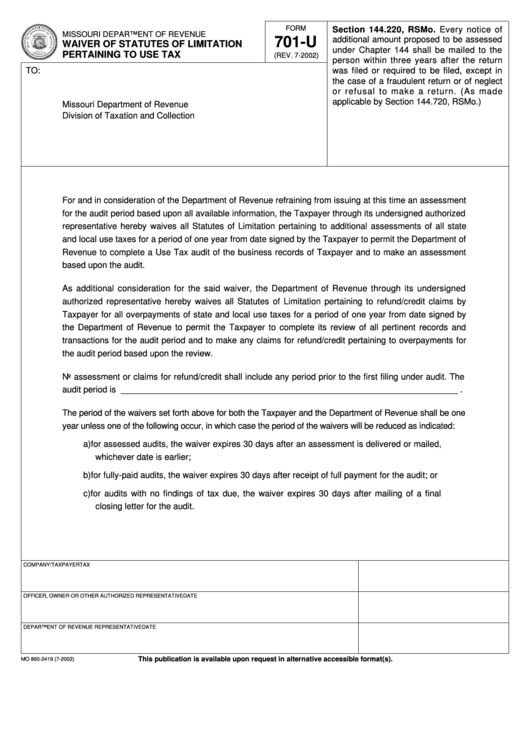

FORM

Section 144.220, RSMo. Every notice of

MISSOURI DEPARTMENT OF REVENUE

701-U

additional amount proposed to be assessed

WAIVER OF STATUTES OF LIMITATION

under Chapter 144 shall be mailed to the

PERTAINING TO USE TAX

(REV. 7-2002)

person within three years after the return

TO:

was filed or required to be filed, except in

the case of a fraudulent return or of neglect

or refusal to make a return. (As made

applicable by Section 144.720, RSMo.)

Missouri Department of Revenue

Division of Taxation and Collection

For and in consideration of the Department of Revenue refraining from issuing at this time an assessment

for the audit period based upon all available information, the Taxpayer through its undersigned authorized

representative hereby waives all Statutes of Limitation pertaining to additional assessments of all state

and local use taxes for a period of one year from date signed by the Taxpayer to permit the Department of

Revenue to complete a Use Tax audit of the business records of Taxpayer and to make an assessment

based upon the audit.

As additional consideration for the said waiver, the Department of Revenue through its undersigned

authorized representative hereby waives all Statutes of Limitation pertaining to refund/credit claims by

Taxpayer for all overpayments of state and local use taxes for a period of one year from date signed by

the Department of Revenue to permit the Taxpayer to complete its review of all pertinent records and

transactions for the audit period and to make any claims for refund/credit pertaining to overpayments for

the audit period based upon the review.

No assessment or claims for refund/credit shall include any period prior to the first filing under audit. The

audit period is _______________________________________________________________________ .

The period of the waivers set forth above for both the Taxpayer and the Department of Revenue shall be one

year unless one of the following occur, in which case the period of the waivers will be reduced as indicated:

a) for assessed audits, the waiver expires 30 days after an assessment is delivered or mailed,

whichever date is earlier;

b) for fully-paid audits, the waiver expires 30 days after receipt of full payment for the audit; or

c) for audits with no findings of tax due, the waiver expires 30 days after mailing of a final

closing letter for the audit.

COMPANY/TAXPAYER

TAX I.D. NUMBER

OFFICER, OWNER OR OTHER AUTHORIZED REPRESENTATIVE

DATE

DEPARTMENT OF REVENUE REPRESENTATIVE

DATE

This publication is available upon request in alternative accessible format(s).

MO 860-2419 (7-2002)

1

1