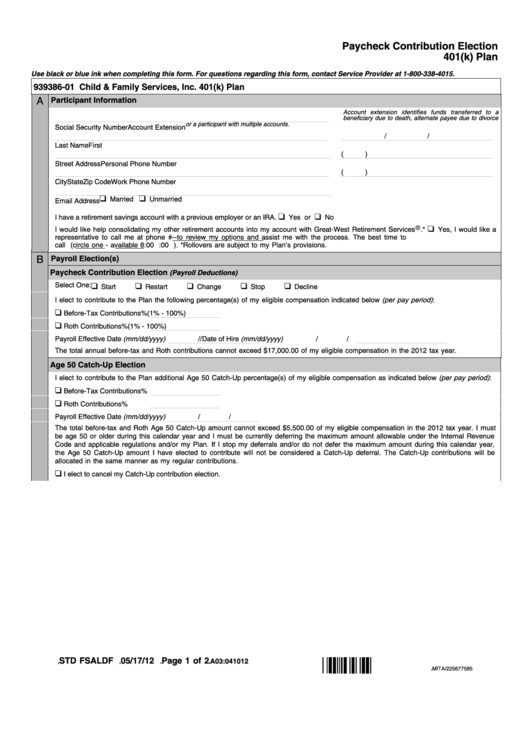

Paycheck Contribution Election

ADVERTISEMENT

Paycheck Contribution Election

401(k) Plan

A

939386-01 Child & Family Services, Inc. 401(k) Plan

B

Participant Information

Use black or blue ink when completing this form. For questions regarding this form, contact Service Provider at 1-800-338-4015.

Social Security Number

Account Extension

/

/

Last Name

First Name

M.I.

Date of Birth

Payroll Election(s)

(

)

Street Address

Personal Phone Number

Paycheck Contribution Election

(

)

City

State

Zip Code

Work Phone Number

Account extension identifies funds transferred to a

beneficiary due to death, alternate payee due to divorce

Married

Unmarried

Email Address

or a participant with multiple accounts.

I have a retirement savings account with a previous employer or an IRA.

Yes or

No

I would like help consolidating my other retirement accounts into my account with Great-West Retirement Services ® .*

Yes, I would like a

representative to call me at phone #

-

-

to review my options and assist me with the process. The best time to

call is

to

A.M./P.M. (circle one - available 8:00 A.M. to 6:00 P.M. MST). *Rollovers are subject to my Plan’s provisions.

(Payroll Deductions)

Age 50 Catch-Up Election

Select One:

Start

Restart

Change

Stop

Decline

I elect to contribute to the Plan the following percentage(s) of my eligible compensation indicated below (per pay period):

Before-Tax Contributions

%

(1% - 100%)

Roth Contributions

%

(1% - 100%)

Payroll Effective Date (mm/dd/yyyy)

/

/

Date of Hire (mm/dd/yyyy)

/

/

The total annual before-tax and Roth contributions cannot exceed $17,000.00 of my eligible compensation in the 2012 tax year.

I elect to contribute to the Plan additional Age 50 Catch-Up percentage(s) of my eligible compensation as indicated below (per pay period):

Before-Tax Contributions

%

Roth Contributions

%

Payroll Effective Date (mm/dd/yyyy)

/

/

The total before-tax and Roth Age 50 Catch-Up amount cannot exceed $5,500.00 of my eligible compensation in the 2012 tax year. I must

be age 50 or older during this calendar year and I must be currently deferring the maximum amount allowable under the Internal Revenue

Code and applicable regulations and/or my Plan. If I stop my deferrals and/or do not defer the maximum amount during this calendar year,

the Age 50 Catch-Up amount I have elected to contribute will not be considered a Catch-Up deferral. The Catch-Up contributions will be

allocated in the same manner as my regular contributions.

STD FSALDF

05/17/12

Page 1 of 2

I elect to cancel my Catch-Up contribution election.

A03:041012

MITA/225677585

][

][

][

][

][

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2