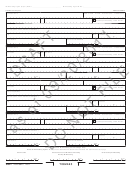

California Form 592 Draft - Resident And Nonresident Withholding Statement - 2012 Page 3

ADVERTISEMENT

Withholding Agent (Payer) Name: _____________________________ Withholding Agent ID No.:__________________

Schedule of Payees

PRINT CLEARLY

Business name

m SSN or ITIN m FEIN m CA Corp no. m SOS file no.

First name

Last name

Initial

m

If backup withholding, check the box.

DBA (if applicable)

Address (suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Total income

Amount of tax withheld

.

.

,

00

,

00

,

,

Business name

m SSN or ITIN m FEIN m CA Corp no. m SOS file no.

First name

Last name

Initial

m

If backup withholding, check the box.

DBA (if applicable)

Address (suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Total income

Amount of tax withheld

.

.

,

,

00

,

,

00

Business name

m SSN or ITIN m FEIN m CA Corp no. m SOS file no.

First name

Last name

Initial

m

If backup withholding, check the box.

DBA (if applicable)

Address (suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Total income

Amount of tax withheld

.

.

,

,

00

,

,

00

Business name

m SSN or ITIN m FEIN m CA Corp no. m SOS file no.

First name

Last name

Initial

m

If backup withholding, check the box.

DBA (if applicable)

Address (suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Total income

Amount of tax withheld

.

.

00

00

,

,

,

,

Total Income and Withholding For This Page Only

Notice to Withholding Agents: We require the total amounts below to be calculated and submitted for each page.

Total Income

Total California Tax Withheld Excluding

Total Backup Withholding

Backup Withholding

.

.

.

00

,

,

00

,

,

,

,

00

Side 2 Form 592

2011

7082123

C3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5