Disability Tax Credit Certificate - Canada Revenue Agency

ADVERTISEMENT

6729

Protected B

when completed

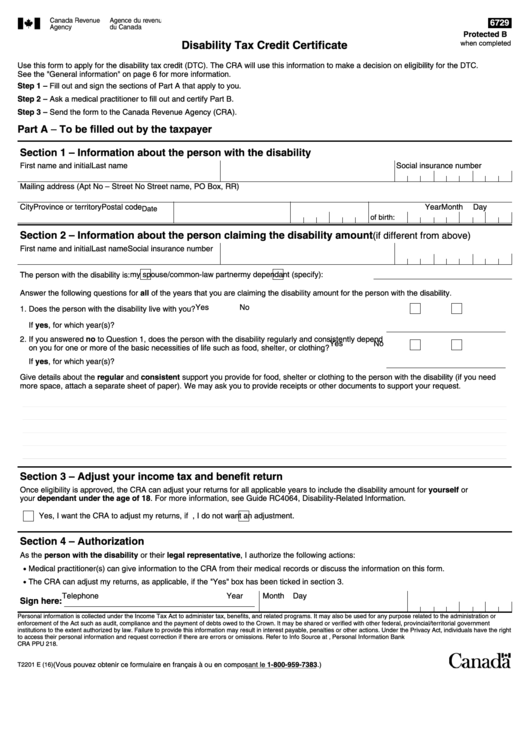

Disability Tax Credit Certificate

Use this form to apply for the disability tax credit (DTC). The CRA will use this information to make a decision on eligibility for the DTC.

See the "General information" on page 6 for more information.

Step 1 – Fill out and sign the sections of Part A that apply to you.

Step 2 – Ask a medical practitioner to fill out and certify Part B.

Step 3 – Send the form to the Canada Revenue Agency (CRA).

Part A – To be filled out by the taxpayer

Section 1 – Information about the person with the disability

First name and initial

Last name

Social insurance number

Mailing address (Apt No – Street No Street name, PO Box, RR)

City

Province or territory

Postal code

Year

Month

Day

Date

of birth:

Section 2 – Information about the person claiming the disability amount

(if different from above)

First name and initial

Last name

Social insurance number

my spouse/common-law partner

my dependant (specify):

The person with the disability is:

Answer the following questions for all of the years that you are claiming the disability amount for the person with the disability.

Yes

No

1. Does the person with the disability live with you?

If yes, for which year(s)?

2. If you answered no to Question 1, does the person with the disability regularly and consistently depend

Yes

No

on you for one or more of the basic necessities of life such as food, shelter, or clothing?

If yes, for which year(s)?

Give details about the regular and consistent support you provide for food, shelter or clothing to the person with the disability (if you need

more space, attach a separate sheet of paper). We may ask you to provide receipts or other documents to support your request.

Section 3 – Adjust your income tax and benefit return

Once eligibility is approved, the CRA can adjust your returns for all applicable years to include the disability amount for yourself or

your dependant under the age of 18. For more information, see Guide RC4064, Disability-Related Information.

Yes, I want the CRA to adjust my returns, if possible.

No, I do not want an adjustment.

Section 4 – Authorization

As the person with the disability or their legal representative, I authorize the following actions:

• Medical practitioner(s) can give information to the CRA from their medical records or discuss the information on this form.

• The CRA can adjust my returns, as applicable, if the "Yes" box has been ticked in section 3.

Telephone

Year

Month

Day

Sign here:

Personal information is collected under the Income Tax Act to administer tax, benefits, and related programs. It may also be used for any purpose related to the administration or

enforcement of the Act such as audit, compliance and the payment of debts owed to the Crown. It may be shared or verified with other federal, provincial/territorial government

institutions to the extent authorized by law. Failure to provide this information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right

to access their personal information and request correction if there are errors or omissions. Refer to Info Source at cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng.html, Personal Information Bank

CRA PPU 218.

(Vous pouvez obtenir ce formulaire en français à

arc.gc.ca/formulaires

ou en composant le 1-800-959-7383.)

T2201 E (16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6