Canada Revenue Agency Forms

Download a blank fillable Canada Revenue Agency Forms in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Canada Revenue Agency Forms with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

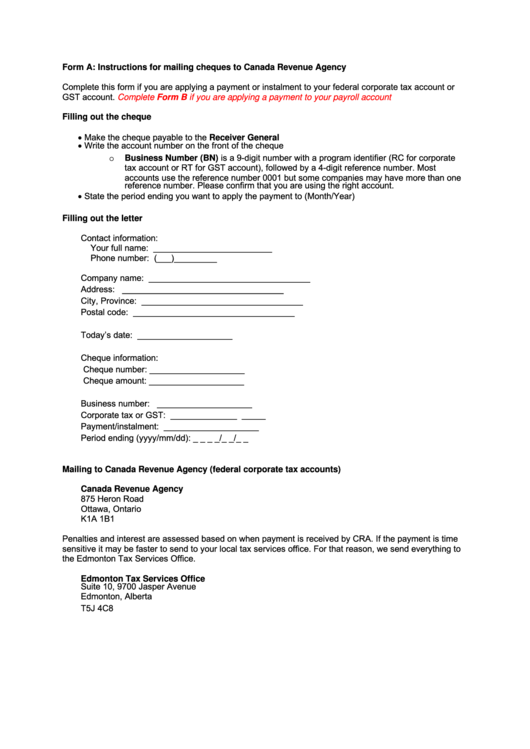

Form A: Instructions for mailing cheques to Canada Revenue Agency

Complete this form if you are applying a payment or instalment to your federal corporate tax account or

GST account.

Complete Form B if you are applying a payment to your payroll account

Filling out the cheque

Make the cheque payable to the Receiver General

Write the account number on the front of the cheque

Business Number (BN) is a 9-digit number with a program identifier (RC for corporate

o

tax account or RT for GST account), followed by a 4-digit reference number. Most

accounts use the reference number 0001 but some companies may have more than one

reference number. Please confirm that you are using the right account.

State the period ending you want to apply the payment to (Month/Year)

Filling out the letter

Contact information:

Your full name:

_________________________

Phone number:

(___)_________

Company name:

__________________________________

Address:

__________________________________

City, Province:

__________________________________

Postal code:

__________________________________

Today’s date:

____________________

Cheque information:

Cheque number:

____________________

Cheque amount:

____________________

Business number:

____________________

Corporate tax or GST:

______________ _____

Payment/instalment:

____________________

Period ending (yyyy/mm/dd):

_ _ _ _ / _ _ / _ _

Mailing to Canada Revenue Agency (federal corporate tax accounts)

Canada Revenue Agency

875 Heron Road

Ottawa, Ontario

K1A 1B1

Penalties and interest are assessed based on when payment is received by CRA. If the payment is time

sensitive it may be faster to send to your local tax services office. For that reason, we send everything to

the Edmonton Tax Services Office.

Edmonton Tax Services Office

Suite 10, 9700 Jasper Avenue

Edmonton, Alberta

T5J 4C8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2