Montana

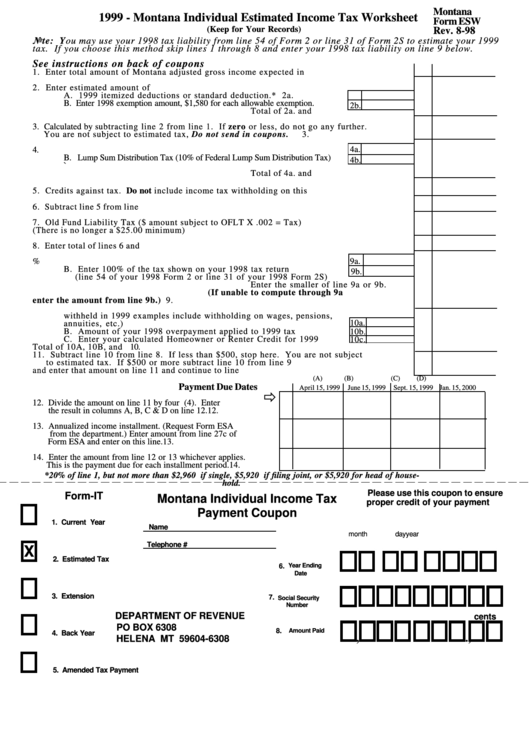

1999 - Montana Individual Estimated Income Tax Worksheet

Form ESW

(Keep for Your Records)

Rev. 8-98

Note: You may use your 1998 tax liability from line 54 of Form 2 or line 31 of Form 2S to estimate your 1999

tax. If you choose this method skip lines 1 through 8 and enter your 1998 tax liability on line 9 below.

See instructions on back of coupons

1. Enter total amount of Montana adjusted gross income expected in 1999................................. 1.

2. Enter estimated amount of

A. 1999 itemized deductions or standard deduction.*

2a.

B. Enter 1998 exemption amount, $1,580 for each allowable exemption.

2b.

Total of 2a. and 2b................................. 2.

3. Calculated by subtracting line 2 from line 1. If zero or less, do not go any further.

You are not subject to estimated tax, Do not send in coupons.

3.

4a.

4. Tax. A. Figure tax on the amount on line 3 by using the tax table on back.

B. Lump Sum Distribution Tax (10% of Federal Lump Sum Distribution Tax)

4b.

`

Total of 4a. and 4b................................ 4.

5. Credits against tax. Do not include income tax withholding on this line............................... 5.

6. Subtract line 5 from line 4................................................................................................. 6.

7. Old Fund Liability Tax ($ amount subject to OFLT X .002 = Tax)

(There is no longer a $25.00 minimum).............................................................................. 7.

8. Enter total of lines 6 and 7................................................................................................ 8.

9.

A. Multiply line 8 by 90%

9a.

B. Enter 100% of the tax shown on your 1998 tax return

9b.

(line 54 of your 1998 Form 2 or line 31 of your 1998 Form 2S)

Enter the smaller of line 9a or 9b.

(If unable to compute through 9a

enter the amount from line 9b.)...........

9.

10.

A. Calculate the amount of Montana individual income tax to be

withheld in 1999 examples include withholding on wages, pensions,

10a.

annuities, etc.)

B. Amount of your 1998 overpayment applied to 1999 tax

10b.

C. Enter your calculated Homeowner or Renter Credit for 1999

10c.

Total of 10A, 10B, and 10C.................. 10.

11. Subtract line 10 from line 8. If less than $500, stop here. You are not subject

to estimated tax. If $500 or more subtract line 10 from line 9

and enter that amount on line 11 and continue to line 12...................................................... 11.

(A)

(B)

(C)

(D)

Payment Due Dates

April 15, 1999

June 15, 1999

Sept. 15, 1999 Jan. 15, 2000

12. Divide the amount on line 11 by four (4). Enter

the result in columns A, B, C & D on line 12.

12.

13. Annualized income installment. (Request Form ESA

from the department.) Enter amount from line 27c of

Form ESA and enter on this line.

13.

14. Enter the amount from line 12 or 13 whichever applies.

This is the payment due for each installment period.

14.

*20% of line 1, but not more than $2,960 if single, $5,920 if filing joint, or $5,920 for head of house-

hold.

Please use this coupon to ensure

Form-IT

Montana Individual Income Tax

proper credit of your payment

Payment Coupon

1. Current Year

Name

month

day

year

Telephone #

X

2. Estimated Tax

6.

Year Ending

Date

3. Extension

7.

Social Security

Number

DEPARTMENT OF REVENUE

cents

PO BOX 6308

8.

Amount Paid

4. Back Year

,

,

.

HELENA MT 59604-6308

5. Amended Tax Payment

1

1