Form Dr-907n - Change Of Address Or Business Name Form - 2002

ADVERTISEMENT

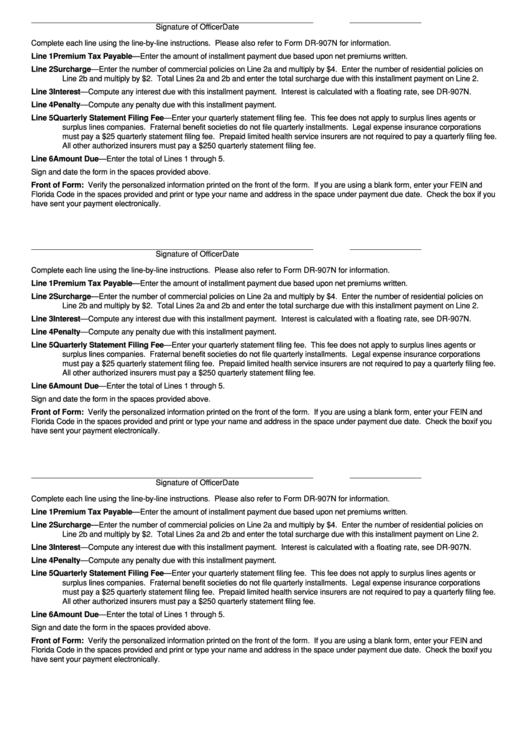

Signature of Officer

Date

Complete each line using the line-by-line instructions. Please also refer to Form DR-907N for information.

Line 1

Premium Tax Payable—Enter the amount of installment payment due based upon net premiums written.

Line 2

Surcharge—Enter the number of commercial policies on Line 2a and multiply by $4. Enter the number of residential policies on

Line 2b and multiply by $2. Total Lines 2a and 2b and enter the total surcharge due with this installment payment on Line 2.

Line 3

Interest—Compute any interest due with this installment payment. Interest is calculated with a floating rate, see DR-907N.

Line 4

Penalty—Compute any penalty due with this installment payment.

Line 5

Quarterly Statement Filing Fee—Enter your quarterly statement filing fee. This fee does not apply to surplus lines agents or

surplus lines companies. Fraternal benefit societies do not file quarterly installments. Legal expense insurance corporations

must pay a $25 quarterly statement filing fee. Prepaid limited health service insurers are not required to pay a quarterly filing fee.

All other authorized insurers must pay a $250 quarterly statement filing fee.

Line 6

Amount Due—Enter the total of Lines 1 through 5.

Sign and date the form in the spaces provided above.

Front of Form: Verify the personalized information printed on the front of the form. If you are using a blank form, enter your FEIN and

Florida Code in the spaces provided and print or type your name and address in the space under payment due date. Check the box if you

have sent your payment electronically.

Signature of Officer

Date

Complete each line using the line-by-line instructions. Please also refer to Form DR-907N for information.

Line 1

Premium Tax Payable—Enter the amount of installment payment due based upon net premiums written.

Line 2

Surcharge—Enter the number of commercial policies on Line 2a and multiply by $4. Enter the number of residential policies on

Line 2b and multiply by $2. Total Lines 2a and 2b and enter the total surcharge due with this installment payment on Line 2.

Line 3

Interest—Compute any interest due with this installment payment. Interest is calculated with a floating rate, see DR-907N.

Line 4

Penalty—Compute any penalty due with this installment payment.

Line 5

Quarterly Statement Filing Fee—Enter your quarterly statement filing fee. This fee does not apply to surplus lines agents or

surplus lines companies. Fraternal benefit societies do not file quarterly installments. Legal expense insurance corporations

must pay a $25 quarterly statement filing fee. Prepaid limited health service insurers are not required to pay a quarterly filing fee.

All other authorized insurers must pay a $250 quarterly statement filing fee.

Line 6

Amount Due—Enter the total of Lines 1 through 5.

Sign and date the form in the spaces provided above.

Front of Form: Verify the personalized information printed on the front of the form. If you are using a blank form, enter your FEIN and

Florida Code in the spaces provided and print or type your name and address in the space under payment due date. Check the box if you

have sent your payment electronically.

Signature of Officer

Date

Complete each line using the line-by-line instructions. Please also refer to Form DR-907N for information.

Line 1

Premium Tax Payable—Enter the amount of installment payment due based upon net premiums written.

Line 2

Surcharge—Enter the number of commercial policies on Line 2a and multiply by $4. Enter the number of residential policies on

Line 2b and multiply by $2. Total Lines 2a and 2b and enter the total surcharge due with this installment payment on Line 2.

Line 3

Interest—Compute any interest due with this installment payment. Interest is calculated with a floating rate, see DR-907N.

Line 4

Penalty—Compute any penalty due with this installment payment.

Line 5

Quarterly Statement Filing Fee—Enter your quarterly statement filing fee. This fee does not apply to surplus lines agents or

surplus lines companies. Fraternal benefit societies do not file quarterly installments. Legal expense insurance corporations

must pay a $25 quarterly statement filing fee. Prepaid limited health service insurers are not required to pay a quarterly filing fee.

All other authorized insurers must pay a $250 quarterly statement filing fee.

Line 6

Amount Due—Enter the total of Lines 1 through 5.

Sign and date the form in the spaces provided above.

Front of Form: Verify the personalized information printed on the front of the form. If you are using a blank form, enter your FEIN and

Florida Code in the spaces provided and print or type your name and address in the space under payment due date. Check the box if you

have sent your payment electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2