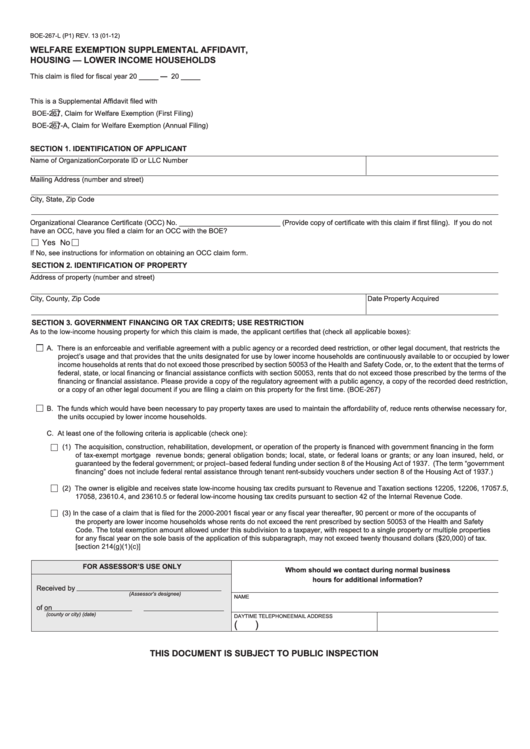

BOE-267-L (P1) REV. 13 (01-12)

WELFARE EXEMPTION SUPPLEMENTAL AFFIDAVIT,

HOUSING — LOWER INCOME HOUSEHOLDS

This claim is filed for fiscal year 20 _____ — 20 _____

This is a Supplemental Affidavit filed with

BOE-267, Claim for Welfare Exemption (First Filing)

BOE-267-A, Claim for Welfare Exemption (Annual Filing)

SECTION 1. IDENTIFICATION OF APPLICANT

Corporate ID or LLC Number

Name of Organization

Mailing Address (number and street)

City, State, Zip Code

Organizational Clearance Certificate (OCC) No. __________________________ (Provide copy of certificate with this claim if first filing). If you do not

have an OCC, have you filed a claim for an OCC with the BOE?

Yes

No

If No, see instructions for information on obtaining an OCC claim form.

SECTION 2. IDENTIFICATION OF PROPERTY

Address of property (number and street)

City, County, Zip Code

Date Property Acquired

SECTION 3. GOVERNMENT FINANCING OR TAX CREDITS; USE RESTRICTION

As to the low-income housing property for which this claim is made, the applicant certifies that (check all applicable boxes):

A. There is an enforceable and verifiable agreement with a public agency or a recorded deed restriction, or other legal document, that restricts the

project’s usage and that provides that the units designated for use by lower income households are continuously available to or occupied by lower

income households at rents that do not exceed those prescribed by section 50053 of the Health and Safety Code, or, to the extent that the terms of

federal, state, or local financing or financial assistance conflicts with section 50053, rents that do not exceed those prescribed by the terms of the

financing or financial assistance. Please provide a copy of the regulatory agreement with a public agency, a copy of the recorded deed restriction,

or a copy of an other legal document if you are filing a claim on this property for the first time. (BOE-267)

B. The funds which would have been necessary to pay property taxes are used to maintain the affordability of, reduce rents otherwise necessary for,

the units occupied by lower income households.

C. At least one of the following criteria is applicable (check one):

(1) The acquisition, construction, rehabilitation, development, or operation of the property is financed with government financing in the form

of tax-exempt mortgage revenue bonds; general obligation bonds; local, state, or federal loans or grants; or any loan insured, held, or

guaranteed by the federal government; or project–based federal funding under section 8 of the Housing Act of 1937. (The term “government

financing” does not include federal rental assistance through tenant rent-subsidy vouchers under section 8 of the Housing Act of 1937.)

(2) The owner is eligible and receives state low-income housing tax credits pursuant to Revenue and Taxation sections 12205, 12206, 17057.5,

17058, 23610.4, and 23610.5 or federal low-income housing tax credits pursuant to section 42 of the Internal Revenue Code.

(3) In the case of a claim that is filed for the 2000-2001 fiscal year or any fiscal year thereafter, 90 percent or more of the occupants of

the property are lower income households whose rents do not exceed the rent prescribed by section 50053 of the Health and Safety

Code. The total exemption amount allowed under this subdivision to a taxpayer, with respect to a single property or multiple properties

for any fiscal year on the sole basis of the application of this subparagraph, may not exceed twenty thousand dollars ($20,000) of tax.

[section 214(g)(1)(c)]

FOR ASSESSOR’S USE ONLY

Whom should we contact during normal business

hours for additional information?

Received by

(Assessor’s designee)

NAME

of

on

(county or city)

(date)

DAYTIME TELEPHONE

EMAIL ADDRESS

(

)

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION

1

1 2

2 3

3