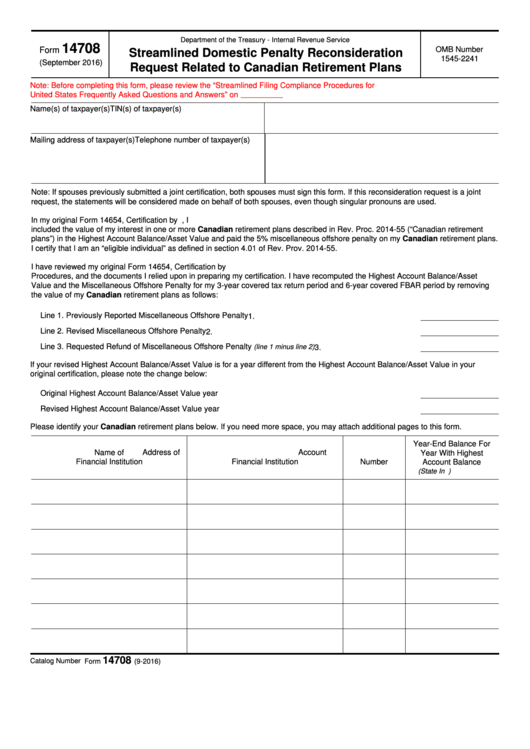

Department of the Treasury - Internal Revenue Service

14708

OMB Number

Form

Streamlined Domestic Penalty Reconsideration

1545-2241

(September 2016)

Request Related to Canadian Retirement Plans

Note: Before completing this form, please review the “Streamlined Filing Compliance Procedures for U.S. Taxpayers Residing in the

United States Frequently Asked Questions and Answers” on

Name(s) of taxpayer(s)

TIN(s) of taxpayer(s)

Mailing address of taxpayer(s)

Telephone number of taxpayer(s)

Note: If spouses previously submitted a joint certification, both spouses must sign this form. If this reconsideration request is a joint

request, the statements will be considered made on behalf of both spouses, even though singular pronouns are used.

In my original Form 14654, Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures, I

included the value of my interest in one or more Canadian retirement plans described in Rev. Proc. 2014-55 (“Canadian retirement

plans”) in the Highest Account Balance/Asset Value and paid the 5% miscellaneous offshore penalty on my Canadian retirement plans.

I certify that I am an “eligible individual” as defined in section 4.01 of Rev. Prov. 2014-55.

I have reviewed my original Form 14654, Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore

Procedures, and the documents I relied upon in preparing my certification. I have recomputed the Highest Account Balance/Asset

Value and the Miscellaneous Offshore Penalty for my 3-year covered tax return period and 6-year covered FBAR period by removing

the value of my Canadian retirement plans as follows:

Line 1. Previously Reported Miscellaneous Offshore Penalty

1.

Line 2. Revised Miscellaneous Offshore Penalty

2.

Line 3. Requested Refund of Miscellaneous Offshore Penalty

(line 1 minus line 2)

3.

If your revised Highest Account Balance/Asset Value is for a year different from the Highest Account Balance/Asset Value in your

original certification, please note the change below:

Original Highest Account Balance/Asset Value year

Revised Highest Account Balance/Asset Value year

Please identify your Canadian retirement plans below. If you need more space, you may attach additional pages to this form.

Year-End Balance For

Name of

Address of

Account

Year With Highest

Financial Institution

Financial Institution

Number

Account Balance

(State In U.S. Dollars)

14708

Catalog Number 67891D

Form

(9-2016)

1

1 2

2