Form 1099-K - Payment Card And Third Party Network Transactions - 2017 Page 6

ADVERTISEMENT

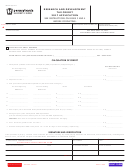

CORRECTED (if checked)

FILER'S name, street address, city or town, state or province, country, ZIP

FILER’S federal identification no.

OMB No. 1545-2205

or foreign postal code, and telephone no.

Payment Card and

PAYEE’S taxpayer identification no.

Third Party

2017

Network

1a Gross amount of payment

Transactions

card/third party network

transactions

$

1099-K

Form

1b Card Not Present

2 Merchant category code

Copy 2

transactions

Check to indicate transactions

$

Check to indicate if FILER is a (an):

reported are:

Payment settlement entity (PSE)

3 Number of payment

4 Federal income tax

Payment card

transactions

withheld

Electronic Payment Facilitator

$

(EPF)/Other third party

Third party network

PAYEE’S name

5a January

5b February

$

$

5c March

5d April

$

$

To be filed with the

Street address (including apt. no.)

recipient's state

5e May

5f June

income tax return,

$

$

when required.

5g July

5h August

$

$

City or town, state or province, country, and ZIP or foreign postal code

5i September

5j October

$

$

PSE’S name and telephone number

5k November

5l December

$

$

Account number (see instructions)

6 State

7 State identification no.

8 State income tax withheld

$

$

1099-K

Form

Department of the Treasury - Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8