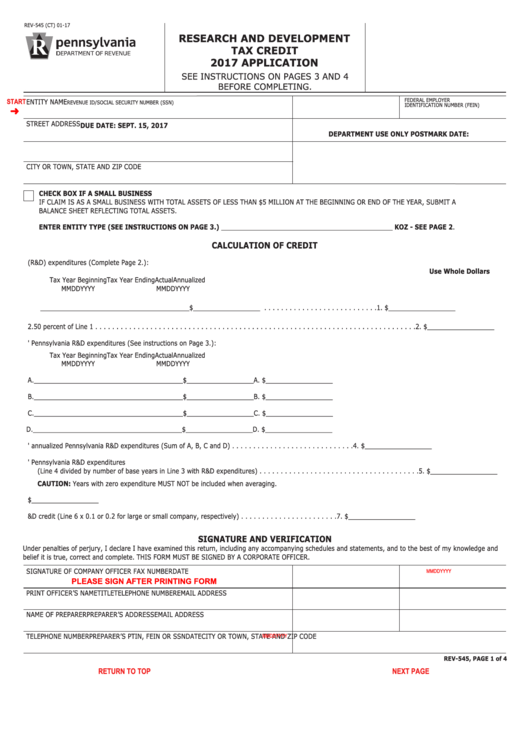

RESEARCH AND DEVELOPMENT

REV-545 (CT) 01-17

TAX CREDIT

2017 APPLICATION

SEE INSTRUCTIONS ON PAGES 3 AND 4

BEFORE COMPLETING.

FEDERAL EMPLOYER

START

ENTITY NAME

REVENUE ID/SOCIAL SECURITY NUMBER (SSN)

IDENTIFICATION NUMBER (FEIN)

DUE DATE: SEPT. 15, 2017

STREET ADDRESS

DEPARTMENT USE ONLY POSTMARK DATE:

CITY OR TOWN, STATE AND ZIP CODE

CHECK BOX IF A SMALL BUSINESS

IF CLAIM IS AS A SMALL BUSINESS WITH TOTAL ASSETS OF LESS THAN $5 MILLION AT THE BEGINNING OR END OF THE YEAR, SUBMIT A

BALANCE SHEET REFLECTING TOTAL ASSETS.

ENTER ENTITY TYPE (SEE INSTRUCTIONS ON PAGE 3.) ______________________________________________ KOZ - SEE PAGE 2.

CALCULATION OF CREDIT

1. Pennsylvania-qualified research and development (R&D) expenditures (Complete Page 2.):

Use Whole Dollars

Tax Year Beginning

Tax Year Ending

Actual

Annualized

MMDDYYYY

MMDDYYYY

____________________

____________________

$__________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $__________________

2. 50 percent of Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $__________________

3. Prior years' Pennsylvania R&D expenditures (See instructions on Page 3.):

Tax Year Beginning

Tax Year Ending

Actual

Annualized

MMDDYYYY

MMDDYYYY

A. ____________________

____________________

$__________________

A. $__________________

B. ____________________

____________________

$__________________

B. $__________________

C. ____________________

____________________

$__________________

C. $__________________

D. ____________________

____________________

$__________________

D. $__________________

4. Total of prior years' annualized Pennsylvania R&D expenditures (Sum of A, B, C and D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $__________________

5. Average of prior years' Pennsylvania R&D expenditures

(Line 4 divided by number of base years in Line 3 with R&D expenditures) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. $__________________

CAUTION: Years with zero expenditure MUST NOT be included when averaging.

6. Line 1 minus the greater of Line 2 or Line 5

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. $__________________

7. Tentative Pennsylvania R&D credit (Line 6 x 0.1 or 0.2 for large or small company, respectively) . . . . . . . . . . . . . . . . . . . . . . . 7. $__________________

SIGNATURE AND VERIFICATION

Under penalties of perjury, I declare I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and

belief it is true, correct and complete. THIS FORM MUST BE SIGNED BY A CORPORATE OFFICER.

SIGNATURE OF COMPANY OFFICER

FAX NUMBER

DATE

MMDDYYYY

PLEASE SIGN AFTER PRINTING FORM

PRINT OFFICER’S NAME

TITLE

TELEPHONE NUMBER

EMAIL ADDRESS

NAME OF PREPARER

PREPARER’S ADDRESS

EMAIL ADDRESS

TELEPHONE NUMBER

PREPARER’S PTIN, FEIN OR SSN

DATE

CITY OR TOWN, STATE AND ZIP CODE

MMDDYYYY

REV-545, PAGE 1 of 4

Reset Entire Form

RETURN TO TOP

NEXT PAGE

PRINT FORM

1

1 2

2 3

3 4

4