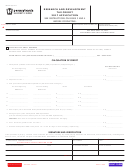

Form 1099-K - Payment Card And Third Party Network Transactions - 2017 Page 8

ADVERTISEMENT

Instructions for FILER Who is a Payment

Due dates. Furnish Copy B of this form to the recipient

by January 31, 2018.

Settlement Entity or Electronic Payment

Facilitator/Other Third Party

File Copy A of this form with the IRS by February 28,

2018. If you file electronically, the due date is April 2,

To complete Form 1099-K, use:

2018. To file electronically, you must have software that

• the 2017 General Instructions for Certain Information

generates a file according to the specifications in Pub.

Returns, and

1220. The IRS does not provide a fill-in form option.

• the 2017 Instructions for Form 1099-K.

Need help? If you have questions about reporting on

Form 1099-K, call the information reporting customer

To order these instructions and additional forms, go

service site toll free at 1-866-455-7438 or 304-263-8700

to

(not toll free). Persons with a hearing or speech

Caution: Because paper forms are scanned during

disability with access to TTY/TDD equipment can call

processing, you cannot file Forms 1096, 1097, 1098,

304-579-4827 (not toll free).

1099, 3921, 3922, or 5498 that you print from the IRS

website.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8