Page 5

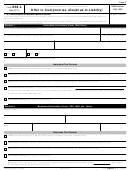

656-L

Department of the Treasury - Internal Revenue Service

OMB Number

Form

Offer in Compromise

(Doubt as to Liability)

1545-1686

(May 2017)

►

To: Commissioner of Internal Revenue Service

IRS Received Date

In the following agreement, the pronoun "we" may be assumed in place of "I" when there are joint liabilities and both parties are

signing this agreement.

I submit this offer to compromise the tax liabilities plus any interest, penalties, additions to tax, and additional amounts required by

law for the tax type and period(s) marked below:

Section 1

Individual Information (Form 1040 filers)

Your First Name, Middle Initial, Last Name

Social Security Number (SSN)

-

-

If a Joint Offer: Spouse's First Name, Middle Initial, Last Name

Social Security Number (SSN)

-

-

Your Physical Home Address

Your Mailing Address

(Street, City, State, ZIP Code)

(if different from your Physical Home Address or Post Office Box Number)

Is this a new address?

If yes, would you like us to update our records to this address?

Yes

No

Yes

No

Employer Identification Number

(For self-employed individuals only)

-

Individual Tax Periods

1040 U.S. Individual Income Tax Return [List all year(s); for example 2009, 2010, etc.]

941 Employer's Quarterly Federal Tax Return [List all quarterly period(s); for example 03/31/2010, 06/30/2010, 09/30/2010, etc.]

940 Employer’s Annual Federal Unemployment (FUTA) Tax Return [List all year(s); for example 2010, 2011, etc.]

Trust Fund Recovery Penalty as a responsible person of (enter business name)

,

for failure to pay withholding and Federal Insurance Contributions Act taxes (Social Security taxes), for period(s) ending [List all quarterly period(s);

for example 03/31/2009, 06/30/2009, etc.]

Other Federal Tax(es) [specify type(s) and period(s)]

Section 2

Business Information (Form 1120, 1065, etc., filers)

Business Name

Business Physical Address

Business Mailing Address

(Street, City, State, ZIP Code)

(Street, City, State, ZIP Code)

Employer Identification Number

Name and Title of Primary Contact

Telephone Number

(EIN)

-

(

)

-

Business Tax Periods

1120 U.S. Corporate Income Tax Return [List all year(s); for example 1120 2010, 1120 2013, etc.]

941 Employer's Quarterly Federal Tax Return [List all quarterly period(s); for example 03/31/2010, 06/30/2010, 09/30/2010, etc.]

940 Employer’s Annual Federal Unemployment (FUTA) Tax Return [List all year(s); for example 2010, 2011, etc.]

Other Federal Tax(es) [specify type(s) and period(s)]

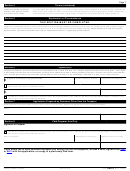

Note: If you need more space, use a separate sheet of paper and title it “Attachment to Form 656-L Dated

.” Sign and date

the attachment following the listing of the tax periods.

656-L

Catalog Number 47516R

Form

(Rev. 1-2018)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8