Instructions For Forms W-2 And W-3 - Wage And Tax Statement And Transmittal Of Wage And Tax Statements - 2017

ADVERTISEMENT

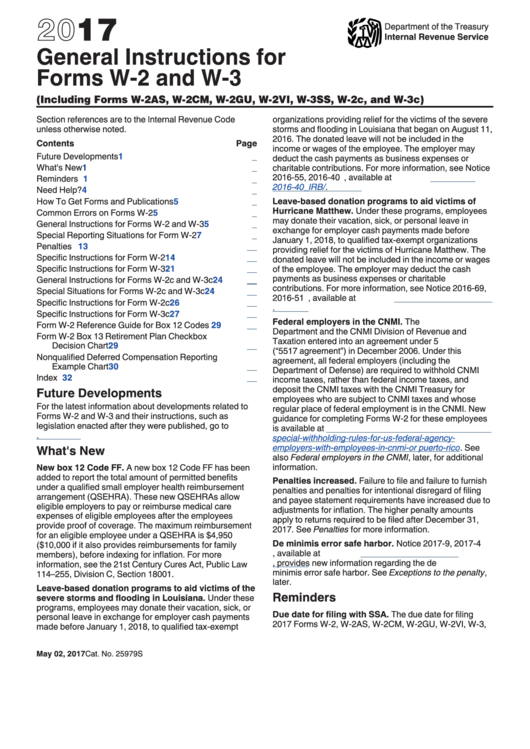

2017

Department of the Treasury

Internal Revenue Service

General Instructions for

Forms W-2 and W-3

(Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)

Section references are to the Internal Revenue Code

organizations providing relief for the victims of the severe

unless otherwise noted.

storms and flooding in Louisiana that began on August 11,

2016. The donated leave will not be included in the

Contents

Page

income or wages of the employee. The employer may

Future Developments

1

. . . . . . . . . . . . . . . . . . . . . . . .

deduct the cash payments as business expenses or

What's New

1

charitable contributions. For more information, see Notice

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2016-55, 2016-40 I.R.B. 432, available at

IRS.gov/irb/

Reminders

1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2016-40_IRB/ar08.html.

Need Help?

4

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Leave-based donation programs to aid victims of

How To Get Forms and Publications

5

. . . . . . . . . . . . .

Hurricane Matthew. Under these programs, employees

Common Errors on Forms W-2

5

. . . . . . . . . . . . . . . . .

may donate their vacation, sick, or personal leave in

General Instructions for Forms W-2 and W-3

5

. . . . . . .

exchange for employer cash payments made before

Special Reporting Situations for Form W-2

7

. . . . . . . . .

January 1, 2018, to qualified tax-exempt organizations

Penalties

13

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

providing relief for the victims of Hurricane Matthew. The

Specific Instructions for Form W-2

14

. . . . . . . . . . . . . .

donated leave will not be included in the income or wages

Specific Instructions for Form W-3

21

of the employee. The employer may deduct the cash

. . . . . . . . . . . . . .

payments as business expenses or charitable

General Instructions for Forms W-2c and W-3c

24

. . . . .

contributions. For more information, see Notice 2016-69,

Special Situations for Forms W-2c and W-3c

24

. . . . . .

2016-51 I.R.B. 832, available at

IRS.gov/irb/2016-51_IRB/

Specific Instructions for Form W-2c

26

. . . . . . . . . . . . .

ar11.html.

Specific Instructions for Form W-3c

27

. . . . . . . . . . . . .

Federal employers in the CNMI. The U.S. Treasury

Form W-2 Reference Guide for Box 12 Codes

29

. . . . .

Department and the CNMI Division of Revenue and

Form W-2 Box 13 Retirement Plan Checkbox

Taxation entered into an agreement under 5 U.S.C. 5517

Decision Chart

29

. . . . . . . . . . . . . . . . . . . . . . . . .

(“5517 agreement”) in December 2006. Under this

Nonqualified Deferred Compensation Reporting

agreement, all federal employers (including the

Example Chart

30

. . . . . . . . . . . . . . . . . . . . . . . . .

Department of Defense) are required to withhold CNMI

Index

32

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

income taxes, rather than federal income taxes, and

deposit the CNMI taxes with the CNMI Treasury for

Future Developments

employees who are subject to CNMI taxes and whose

For the latest information about developments related to

regular place of federal employment is in the CNMI. New

Forms W-2 and W-3 and their instructions, such as

guidance for completing Forms W-2 for these employees

legislation enacted after they were published, go to

is available at

IRS.gov/individuals/international-taxpayers/

IRS.gov/w2.

special-withholding-rules-for-us-federal-agency-

employers-with-employees-in-cnmi-or

puerto-rico. See

What's New

also Federal employers in the CNMI, later, for additional

information.

New box 12 Code FF. A new box 12 Code FF has been

added to report the total amount of permitted benefits

Penalties increased. Failure to file and failure to furnish

under a qualified small employer health reimbursement

penalties and penalties for intentional disregard of filing

arrangement (QSEHRA). These new QSEHRAs allow

and payee statement requirements have increased due to

eligible employers to pay or reimburse medical care

adjustments for inflation. The higher penalty amounts

expenses of eligible employees after the employees

apply to returns required to be filed after December 31,

provide proof of coverage. The maximum reimbursement

2017. See Penalties for more information.

for an eligible employee under a QSEHRA is $4,950

De minimis error safe harbor. Notice 2017-9, 2017-4

($10,000 if it also provides reimbursements for family

I.R.B. 542, available at

IRS.gov/irb/2017-04_IRB/

members), before indexing for inflation. For more

ar11.html, provides new information regarding the de

information, see the 21st Century Cures Act, Public Law

minimis error safe harbor. See Exceptions to the penalty,

114–255, Division C, Section 18001.

later.

Leave-based donation programs to aid victims of the

Reminders

severe storms and flooding in Louisiana. Under these

programs, employees may donate their vacation, sick, or

Due date for filing with SSA. The due date for filing

personal leave in exchange for employer cash payments

2017 Forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, W-3,

made before January 1, 2018, to qualified tax-exempt

May 02, 2017

Cat. No. 25979S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33