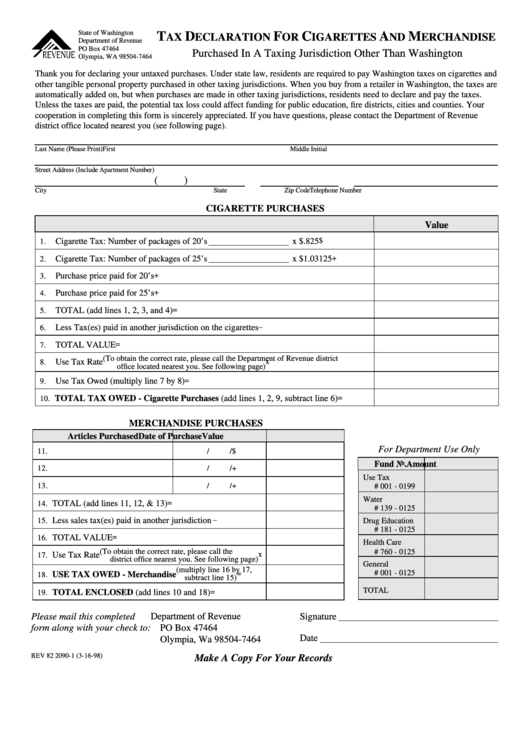

State of Washington

T

D

F

C

A

M

AX

ECLARATION

OR

IGARETTES

ND

ERCHANDISE

Department of Revenue

PO Box 47464

Purchased In A Taxing Jurisdiction Other Than Washington

Olympia, WA 98504-7464

Thank you for declaring your untaxed purchases. Under state law, residents are required to pay Washington taxes on cigarettes and

other tangible personal property purchased in other taxing jurisdictions. When you buy from a retailer in Washington, the taxes are

automatically added on, but when purchases are made in other taxing jurisdictions, residents need to declare and pay the taxes.

Unless the taxes are paid, the potential tax loss could affect funding for public education, fire districts, cities and counties. Your

cooperation in completing this form is sincerely appreciated. If you have questions, please contact the Department of Revenue

district office located nearest you (see following page).

Last Name (Please Print)

First

Middle Initial

Street Address (Include Apartment Number)

(

)

City

State

Zip Code

Telephone Number

CIGARETTE PURCHASES

Value

$

Cigarette Tax: Number of packages of 20’s

x $.825

1.

+

Cigarette Tax: Number of packages of 25’s

x $1.03125

2.

Purchase price paid for 20’s .............................................................................................

+

3.

Purchase price paid for 25’s .............................................................................................

+

4.

TOTAL (add lines 1, 2, 3, and 4) .....................................................................................

=

5.

Less Tax(es) paid in another jurisdiction on the cigarettes................................................

–

6.

=

TOTAL VALUE..............................................................................................................

7.

(To obtain the correct rate, please call the Department of Revenue district

x

Use Tax Rate

8.

office located nearest you. See following page)................................................

Use Tax Owed (multiply line 7 by 8)................................................................................

=

9.

=

TOTAL TAX OWED - Cigarette Purchases (add lines 1, 2, 9, subtract line 6) .............

10.

MERCHANDISE PURCHASES

Articles Purchased

Date of Purchase

Value

For Department Use Only

11.

/

/

$

Fund No.

Amount

12.

/

/

+

Use Tax

13.

/

/

+

# 001 - 0199

Water

=

TOTAL (add lines 11, 12, & 13) ........................................

14.

# 139 - 0125

–

Less sales tax(es) paid in another jurisdiction .....................

15.

Drug Education

# 181 - 0125

=

TOTAL VALUE ................................................................

16.

Health Care

(To obtain the correct rate, please call the

# 760 - 0125

Use Tax Rate

x

17.

district office nearest you. See following page)

General

(multiply line 16 by 17,

# 001 - 0125

=

USE TAX OWED - Merchandise

18.

subtract line 15) .........

TOTAL

=

TOTAL ENCLOSED (add lines 10 and 18)......................

19.

Please mail this completed

Department of Revenue

Signature

form along with your check to:

PO Box 47464

Date

Olympia, Wa 98504-7464

REV 82 2090-1 (3-16-98)

Make A Copy For Your Records

1

1