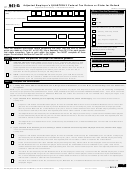

Name (not your trade name)

Employer identification number (EIN)

Correcting quarter

(1, 2, 3, 4)

Correcting calendar year (YYYY)

Part 3:

Continued

21.

.

Amount from line 20 on page 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

DRAFT AS OF

If line 21 is less than zero:

• If you checked line 1, this is the amount you want applied as a credit to your Form 941 or Form 941-SS for the tax period in which

you are filing this form. If you are currently filing Form 944, Employer’s ANNUAL Federal Tax Return, see the instructions.

• If you checked line 2, this is the amount you want refunded or abated.

If line 21 is more than zero, this is the amount you owe. Pay this amount by the time you file this return. For information on how to

pay, see Amount you owe in the instructions.

April 30, 2012

Part 4:

Explain your corrections for this quarter.

22.

Check here if any corrections you entered on a line include both underreported and overreported amounts. Explain both

your underreported and overreported amounts on line 24.

23.

Check here if any corrections involve reclassified workers. Explain on line 24.

24.

You must give us a detailed explanation of how you determined your corrections. See the instructions.

DO NOT FILE

Part 5:

Sign here. You must complete all three pages of this form and sign it.

Under penalties of perjury, I declare that I have filed an original Form 941 or Form 941-SS and that I have examined this adjusted return or claim, including

accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other

than taxpayer) is based on all information of which preparer has any knowledge.

Print your

name here

Sign your

Print your

name here

title here

Date

/

/

Best daytime phone

Paid Preparer Use Only

Check if you are self-employed .

.

.

Preparer’s name

PTIN

Date

/

/

Preparer’s signature

Firm’s name (or yours

EIN

if self-employed)

Address

Phone

City

State

ZIP code

3

941-X

Page

Form

(Rev. 4-2012)

1

1 2

2 3

3 4

4 5

5