DUALTT-AONM-YRXY-MOHJ-EUJY

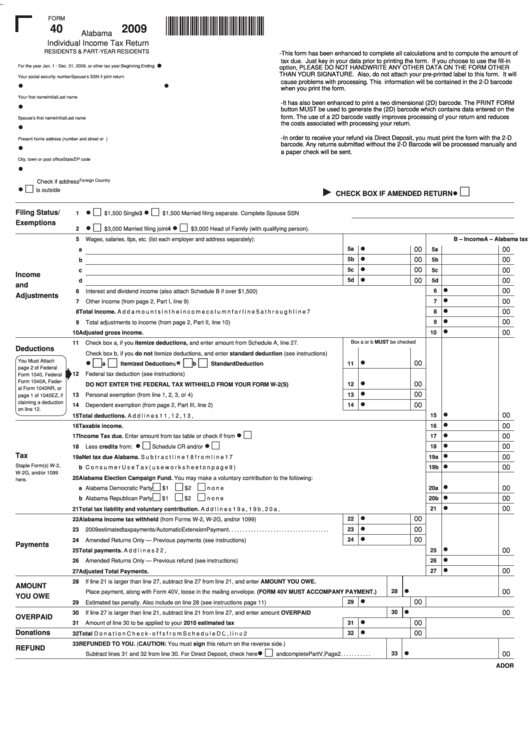

FORM

09110140

40

2009

Calculate

Print

Alabama

Reset

Individual Income Tax Return

RESIDENTS & PART-YEAR RESIDENTS

-This form has been enhanced to complete all calculations and to compute the amount of

tax due. Just key in your data prior to printing the form. If you choose to use the fill-in

•

For the year Jan. 1 - Dec. 31, 2009, or other tax year:

Beginning:

Ending:

option, PLEASE DO NOT HANDWRITE ANY OTHER DATA ON THE FORM OTHER

THAN YOUR SIGNATURE. Also, do not attach your pre-printed label to this form. It will

Your social security number

Spouse’s SSN if joint return

cause problems with processing. This information will be contained in the 2-D barcode

•

•

when you print the form.

Your first name

Initial

Last name

-It has also been enhanced to print a two dimensional (2D) barcode. The PRINT FORM

•

button MUST be used to generate the (2D) barcode which contains data entered on the

form. The use of a 2D barcode vastly improves processing of your return and reduces

Spouse’s first name

Initial

Last name

the costs associated with processing your return.

•

-In order to receive your refund via Direct Deposit, you must print the form with the 2-D

Present home address (number and street or P.O. Box number)

barcode. Any returns submitted without the 2-D Barcode will be processed manually and

•

a paper check will be sent.

City, town or post office

State

ZIP code

•

Foreign Country

Check if address

•

is outside U.S.

•

CHECK BOX IF AMENDED RETURN

•

•

Filing Status/

1

$1,500 Single

3

$1,500 Married filing separate. Complete Spouse SSN

Exemptions

•

•

2

$3,000 Married filing joint

4

$3,000 Head of Family (with qualifying person).

5 Wages, salaries, tips, etc. (list each employer and address separately):

A – Alabama tax withheld

B – Income

•

00

00

5a

a

5a

•

00

00

5b

b

5b

•

00

00

5c

c

5c

Income

•

00

00

5d

d

5d

and

•

00

6 Interest and dividend income (also attach Schedule B if over $1,500) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Go To Schedule B

Adjustments

•

00

7 Other income (from page 2, Part I, line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Go to Page 2, Part I

•

00

8 Total income. Add amounts in the income column for line 5a through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

•

00

9 Total adjustments to income (from page 2, Part II, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Go To Page 2, Part II

•

00

10 Adjusted gross income. Subtract line 9 from line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Box a or b MUST be checked

11 Check box a, if you itemize deductions, and enter amount from Schedule A, line 27.

Deductions

Check box b, if you do not itemize deductions, and enter standard deduction (see instructions)

You Must Attach

•

•

•

00

a

Itemized Deductions

b

Standard Deduction . . . . . . . . . . . . . . . . . . . . . . . . . .

11

SCH A

page 2 of Federal

12 Federal tax deduction (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 1040, Federal

Go To Federal Income Tax Deduction Worksheet

Form 1040A, Feder-

•

00

DO NOT ENTER THE FEDERAL TAX WITHHELD FROM YOUR FORM W-2(S)

12

al Form 1040NR, or

•

00

13 Personal exemption (from line 1, 2, 3, or 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

page 1 of 1040EZ, if

claiming a deduction

•

00

14 Dependent exemption (from page 2, Part III, line 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

GO TO PAGE 2, PART III

on line 12.

•

00

15 Total deductions. Add lines 11, 12, 13, and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

•

00

16 Taxable income. Subtract line 15 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

•

•

00

17 Income Tax due. Enter amount from tax table or check if from

Form NOL-85A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

•

•

•

00

18 Less credits from:

Schedule CR and/or

Schedule OC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SCH OC

18

Tax

•

00

19a Net tax due Alabama. Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19a

•

Staple Form(s) W-2,

00

b Consumer Use Tax (use worksheet on page 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19b

W-2G, and/or 1099

20 Alabama Election Campaign Fund. You may make a voluntary contribution to the following:

here.

•

00

a Alabama Democratic Party

$1

$2

none . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20a

•

00

b Alabama Republican Party

$1

$2

none . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20b

•

00

21 Total tax liability and voluntary contribution. Add lines 19a, 19b, 20a, and 20b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

•

00

22 Alabama income tax withheld (from Forms W-2, W-2G, and/or 1099) . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

•

00

23 2009 estimated tax payments/Automatic Extension Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

•

00

24 Amended Returns Only — Previous payments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

Payments

•

00

25 Total payments. Add lines 22, 23 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

•

26 Amended Returns Only — Previous refund (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

•

00

27 Adjusted Total Payments. Subtract line 26 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 If line 21 is larger than line 27, subtract line 27 from line 21, and enter AMOUNT YOU OWE.

AMOUNT

•

28

00

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.)

YOU OWE

•

00

29 Estimated tax penalty. Also include on line 28 (see instructions page 11) . . . . . . . . . . . . . . . . . . . . . . . . . .

29

•

30

00

30 If line 27 is larger than line 21, subtract line 21 from line 27, and enter amount OVERPAID . . . . . . . . . . . . . . . . . . . . . . . . . .

OVERPAID

•

00

31 Amount of line 30 to be applied to your 2010 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

•

Donations

00

32 Total Donation Check-offs from Schedule DC, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

SCH DC

33 REFUNDED TO YOU. (CAUTION: You must sign this return on the reverse side.)

REFUND

•

•

33

00

Subtract lines 31 and 32 from line 30. For Direct Deposit, check here

and complete Part V, Page 2 . . . . . . . . . . .

ADOR

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10