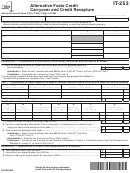

Part II Credit Recapture

A

Purpose

Use form FTB 3540, Credit Carryover and Recapture Summary, Part II to

compute any recapture. You must keep your old tax returns along with

the appropriate information to substantiate the credits recaptured on this

form. The FTB can request that information even on tax returns for years

that are past the statute of limitations.

B

Credit Recapture Definition

Code 189 – Employer Childcare Program Credit (ECPC)

If the childcare center is disposed of or stops operating within

60 months after completion, the portion of the credit claimed that

represents the remaining portion of the 60-month period must be

recaptured. You must add the recapture amount to your tax liability in

the taxable year of disposition or nonuse.

Code 207– Farmworker Housing Credit (FWHC)

If the FWHC was allocated under the former FWHC provision prior to

January 1, 2009, and the property is disposed of or stops operating,

with respect to the costs of constructing or rehabilitating farmworker

housing, within 360 months after completion, the portion of the credit

claimed that represents the portion of the 360-month period must be

recaptured.

Specific Column Instructions

Column (c) – Include the recaptured amount from Part II, column (c),

for each credit on your California tax return or schedule as follows:

y Form 540, line 63

y Long Form 540NR, line 73

y Form 541, line 37

y Form 100, Schedule J, line 5

y Form 100S, Schedule J, line 5

y Form 100W, Schedule J, line 5

y Form 109, Schedule K, line 4

y Form 565, Schedule K, line 20c

y Form 568, Schedule K, line 20c.

Indicate that a credit recapture is included on the tax return by writing

“FTB 3540” in the space provided or next to the line on the schedule or

form.

Estates, trusts, partnerships, and LLCs, classified as partnerships,

must identify the recapture amounts for their beneficiaries, partners,

and members on Schedule K-1 (541, 565, or 568) Share of Income,

Deductions, Credits, etc.

In addition, S corporations must identify recapture amounts for their

shareholders on Schedule K-1 (100S), which will differ from the amount

recaptured by the S corporation on Form 100S, California S Corporation

Franchise or Income Tax Return, Schedule J, line 5.

Page 3 FTB 3540 Instructions 2016

1

1 2

2 3

3 4

4