0-L1795282944 rtL001

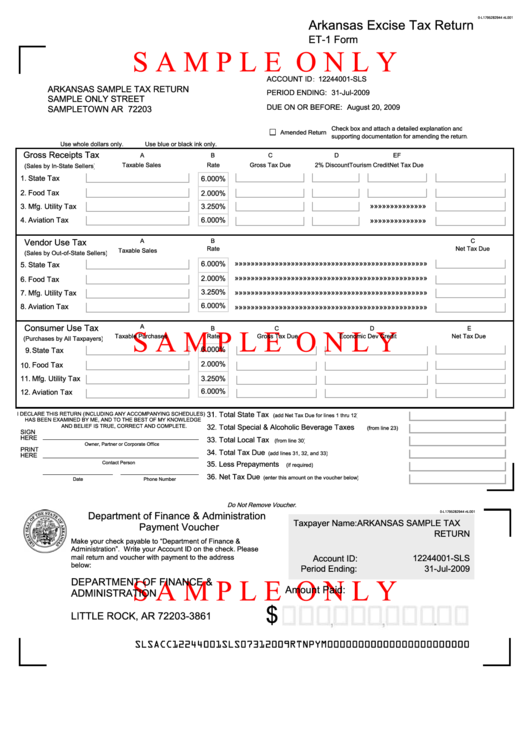

Arkansas Excise Tax Return

ET-1 Form

S A M P L E O N L Y

ACCOUNT ID

12244001-SLS

:

ARKANSAS SAMPLE TAX RETURN

PERIOD ENDING: 31-Jul-2009

SAMPLE ONLY STREET

DUE ON OR BEFORE: August 20, 2009

SAMPLETOWN AR 72203

Check box and attach a detailed explanation and

Amended Return

supporting documentation for amending the return.

Use whole dollars only.

Use blue or black ink only.

Gross Receipts Tax

A

B

C

D

E

F

Taxable Sales

Rate

Gross Tax Due

2% Discount

Tourism Credit

Net Tax Due

(Sales by In-State Sellers)

1. State Tax

6.000%

2.

Food Tax

2.000%

3.

Mfg. Utility Tax

3.250%

»»»»»»»»»»»»»»

4.

Aviation Tax

6.000%

»»»»»»»»»»»»»»

Vendor Use Tax

A

B

C

Rate

Net Tax Due

Taxable Sales

(Sales by Out-of-State Sellers)

6.000%

5.

State Tax

»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»

2.000%

6.

Food Tax

»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»

3.250%

7.

Mfg. Utility Tax

»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»

6.000%

8.

Aviation Tax

»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»»

Consumer Use Tax

A

S A M P L E O N L Y

B

C

D

E

Taxable Purchases

Rate

Gross Tax Due

Economic Dev Credit

Net Tax Due

(Purchases by All Taxpayers)

6.000%

9.

State Tax

2.000%

10.

Food Tax

11.

Mfg. Utility Tax

3.250%

6.000%

12.

Aviation Tax

31. Total State Tax

........................

I DECLARE THIS RETURN (INCLUDING ANY ACCOMPANYING SCHEDULES)

(add Net Tax Due for lines 1 thru 12)

HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY KNOWLEDGE

AND BELIEF IS TRUE, CORRECT AND COMPLETE.

Total Special & Alcoholic Beverage Taxes

....

32.

(from line 23)

SIGN

HERE

Total Local Tax

33.

.................................................

(from line 30)

Owner, Partner or Corporate Officer

PRINT

Total Tax Due

......................................

34.

(add lines 31, 32, and 33)

HERE

Contact Person

Less Prepayments

.............................................

35.

(if required)

Net Tax Due

.......................

36.

(enter this amount on the voucher below)

Date

Phone Number

Do Not Remove Voucher.

Department of Finance & Administration

0-L1795282944 rtL001

Taxpayer Name: ARKANSAS SAMPLE TAX

Payment Voucher

RETURN

Make your check payable to “Department of Finance &

Administration”. Write your Account ID on the check. Please

mail return and voucher with payment to the address

Account ID:

12244001-SLS

below:

Period Ending:

31-Jul-2009

S A M P L E O N L Y

DEPARTMENT OF FINANCE &

Amount Paid:

ADMINISTRATION

P.O. BOX 3861

$

LITTLE ROCK, AR 72203-3861

SLSACC12244001SLS07312009RTNPYM00000000000000000000000

1

1 2

2 3

3