Form Ri 1099-Pt - Draft - Pass-Through Withholding - 2009 Page 2

ADVERTISEMENT

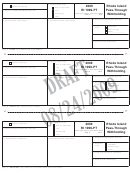

3.

2. Payer’s Entity Type

2009

Rhode Island

Check if corrected

Sub S Corporation

RI 1099-PT

Pass-Through

LLC

1. Payer’s Federal Identification Number

Partnership

Fiscal year payers, enter fiscal dates

Withholding

, 2009 to

, 2010

Trust

6. Recipient’s Identification Number

4. Payer’s Name and Address

5. Recipient’s Name and Address

7. Recipient

Individual

Type

Pass-through

Other ____________

8. Recipient’s percent of ownership

9. Recipient’s RI Withholding

Copy D - RECIPIENT copy (retain for your records)

INSTRUCTIONS

For more information on pass-through entity withholding or to obtain forms, refer to Rhode Island Division of Taxation’s website :

or call (401) 574-8970.

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

PURPOSE: Form RI 1099-PT is used to report Rhode

Box 1 – Enter the Federal Identification Number of the pass-

Island pass-through entity withholding for nonresident part-

through entity generating the Rhode Island source income for

ners, members, beneficiaries and shareholders.

the recipient and submitting the withholding tax payments on

behalf of the recipient.

FOR THE RECIPIENT: The amount in box 8 represents the

amount of Rhode Island taxes withheld by the pass-through

Box 2 – Check-off the pass-through entity type.

entity on your behalf. Please note that your total pass-

through entity income is not reported on this form. The total

Box 3 – If the pass-through entity operates on a fiscal year

income will be reported to you on Federal Schedule K-1 by

rather than a calender year, enter the fiscal year dates.

the pass-through entity of which you are an owner or benefi-

ciary. A copy of this form RI 1099-PT must be attached to

Box 4 – Enter the pass-through entity’s name and address.

your Rhode Island Income Tax return in order to receive

credit for any withholding made on your behalf.

Box 5 – Enter the recipient’s name and address.

FOR THE ENTITY: The pass-through entity must supply

Box 6 – Enter the recipient’s Identification Number.

each nonresident member with a copy of Form RI 1099-PT,

showing the amount of Rhode Island withholding for that

Box 7 – Check-off the recipient type if known. Otherwise

member. For a Sub S Corporation, Form RI 1099-PT must

leave blank.

be issued to the nonresident member(s) no later than the fif-

teenth day of the third month following the close of the enti-

Box 8 – Enter the recipient’s percentage of ownership in this

ty’s tax year. For an LLC, partnership or trust, Form RI

pass-through entity.

1099-PT must be issued to the nonresident member(s) no

later than the fifteenth day of the fourth month following the

Box 9 – Enter the amount of Rhode Island taxes withheld on

close of the entity’s tax year. The member must attach this

behalf of the recipient by this pass-through entity.

form to their Rhode Island Income Tax return in order to sub-

stantiate the amount withheld.

The pass-through entity is required to submit a copy of this

form to the Rhode Island Division of Taxation with its filing of

Form RI 1096-PT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2