Form 31-089 - Iowa Regular Local Option Tax And School Local Option Tax

ADVERTISEMENT

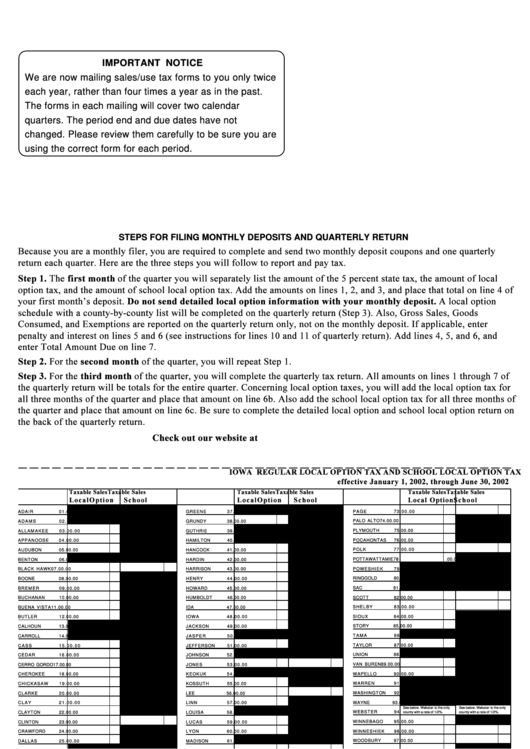

IMPORTANT NOTICE

We are now mailing sales/use tax forms to you only twice

each year, rather than four times a year as in the past.

The forms in each mailing will cover two calendar

quarters. The period end and due dates have not

changed. Please review them carefully to be sure you are

using the correct form for each period.

STEPS FOR FILING MONTHLY DEPOSITS AND QUARTERLY RETURN

Because you are a monthly filer, you are required to complete and send two monthly deposit coupons and one quarterly

return each quarter. Here are the three steps you will follow to report and pay tax.

Step 1. The first month of the quarter you will separately list the amount of the 5 percent state tax, the amount of local

option tax, and the amount of school local option tax. Add the amounts on lines 1, 2, and 3, and place that total on line 4 of

your first month’s deposit. Do not send detailed local option information with your monthly deposit. A local option

schedule with a county-by-county list will be completed on the quarterly return (Step 3). Also, Gross Sales, Goods

Consumed, and Exemptions are reported on the quarterly return only, not on the monthly deposit. If applicable, enter

penalty and interest on lines 5 and 6 (see instructions for lines 10 and 11 of quarterly return). Add lines 4, 5, and 6, and

enter Total Amount Due on line 7.

Step 2. For the second month of the quarter, you will repeat Step 1.

Step 3. For the third month of the quarter, you will complete the quarterly tax return. All amounts on lines 1 through 7 of

the quarterly return will be totals for the entire quarter. Concerning local option taxes, you will add the local option tax for

all three months of the quarter and place that amount on line 6b. Also add the school local option tax for all three months of

the quarter and place that amount on line 6c. Be sure to complete the detailed local option and school local option return on

the back of the quarterly return.

Check out our website at

IOWA REGULAR LOCAL OPTION TAX AND SCHOOL LOCAL OPTION TAX

effective January 1, 2002, through June 30, 2002

Taxable Sales

Taxable Sales

Taxable Sales

Taxable Sales

Taxable Sales

Taxable Sales

LocalOption

School

LocalOption

School

Local Option

S c h o o l

P A G E

73

.00

.00

AD A IR

01

.00

.00

GREENE

37

.00

.00

A D A M S

02

.00

.00

GRUNDY

38

.00

.00

PALO ALTO

74

.00

.00

PLYMOUTH

75

.00

.00

A L L A M A K E E

03

.00

.00

GUTHRIE

39

.00

.00

POCAHONTAS

76

.00

.00

APPANOOSE

04

.00

.00

HAMILTON

40

.00

.00

P O L K

77

.00

.00

AUDUBON

05

.00

.00

HANCOCK

41

.00

.00

BENTON

06

.00

.00

HARDIN

42

.00

.00

POTTAWATTAMIE78

.00

.00

BLACK HAWK

07

.00

.00

HARRISON

43

.00

.00

P O W E S H I E K

79

.00

.00

RINGGOLD

80

.00

.00

BOONE

08

.00

.00

HENRY

44

.00

.00

SAC

81

.00

.00

B R E M E R

09

.00

.00

HOWARD

45

.00

.00

BUCHANAN

10

.00

.00

HUMBOLDT

46

.00

.00

SCOTT

82

.00

.00

BUENA VISTA

11

.00

.00

IDA

47

.00

.00

S H E L B Y

83

.00

.00

SIOUX

84

.00

.00

BUTLER

12

.00

.00

I O W A

48

.00

.00

STORY

85

.00

.00

CALHOUN

13

.00

.00

JACKSON

49

.00

.00

.00

T A M A

86

.00

.00

CARROLL

14

.00

.00

J A S P E R

50

.00

.00

TAYLOR

87

.00

.00

C A S S

15

.00

.00

JEFFERSON

51

.00

.00

.00

UNION

88

.00

.00

CEDAR

16

.00

.00

JOHNSON

52

.00

.00

VAN BUREN

89

.00

.00

CERRO GORDO

17

.00

.00

J O N E S

53

.00

.00

CHEROKEE

18

.00

.00

KEOKUK

54

.00

.00

WAPELLO

90

.00

.00

C H I C K A S A W

19

.00

.00

KOSSUTH

55

.00

.00

W A R R EN

91

.00

.00

WASHINGTON

92

.00

.00

CLARKE

20

.00

.00

LEE

56

.00

.00

W A Y N E

93

.00

.00

C L A Y

21

.00

.00

LINN

57

.00

.00

See below. Webster is the only

See below. Webster is the only

CLAYTON

22

.00

.00

LOUISA

58

.00

.00

WEBSTER

94

county with a rate of 1/2%.

county with a rate of 1/2%.

CLINTON

23

.00

.00

L U C A S

59

.00

.00

WINNEBAGO

95

.00

.00

WINNESHIEK

96

.00

.00

CRAWFORD

24

.00

.00

LYON

60

.00

.00

.00

WOODBURY

97

.00

.00

D A L L A S

25

.00

.00

MADISON

61

.00

.00

WORTH

98

.00

.00

D A V I S

26

.00

.00

M A H A S K A

62

.00

.00

DECATUR

27

.00

.00

MARION

63

.00

.00

WRIGHT

99

.00

.00

TOTAL

DELAWARE

28

.00

.00

MARSHALL

64

.00

.00

TAXABLE SALES

. 0 0

. 0 0

DES MOINES

29

.00

.00

MILLS

65

.00

.00

MULTIPLY BY .01

.00A

.00B

DICKINSON

30

.00

.00

MITCHELL

66

.00

.00

WEBSTER CO.

94

DUBUQUE

31

.00

.00

MONONA

67

.00

.00

TOTAL

TAXABLE SALES

. 0 0

. 0 0

E M M E T

32

.00

.00

MONROE

68

.00

.00

MULTIPLY BY .005

.00C

.00D

FAYETTE

33

.00

.00

MONTGOMERY

69

.00

.00

ADD A & C

ADD B & D

TOTAL TAX

. 0 0

. 0 0

FLOYD

34

.00

.00

MUSCATINE

70

.00

.00

ENTER ON FRONT

ENTER ON FRONT

FRANKLIN

35

.00

.00

O’BRIEN

71

.00

.00

OF RETURN, LINE 6b

OF RETURN, LINE 6c

.00

FREMONT

36

.00

.00

OSCEOLA

72

.00

.00

31-089 rf04b (11/19/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3