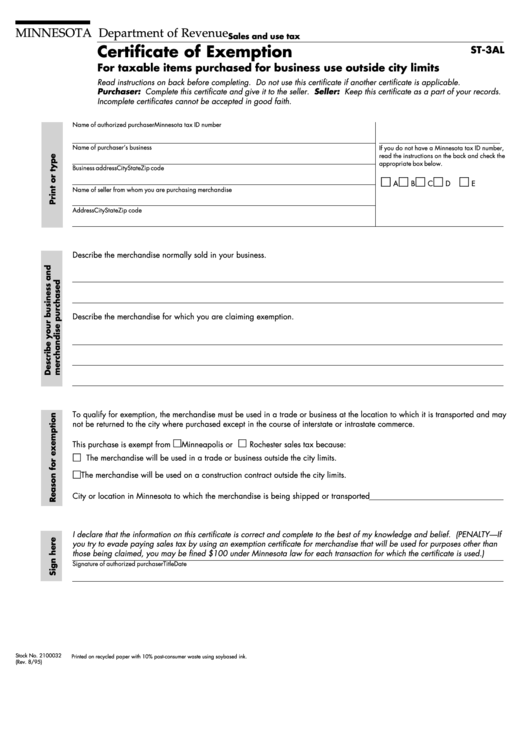

MINNESOTA Department of Revenue

Sales and use tax

Certificate of Exemption

ST-3AL

For taxable items purchased for business use outside city limits

Read instructions on back before completing. Do not use this certificate if another certificate is applicable.

Purchaser: Complete this certificate and give it to the seller. Seller: Keep this certificate as a part of your records.

Incomplete certificates cannot be accepted in good faith.

Name of authorized purchaser

Minnesota tax ID number

Name of purchaser’s business

If you do not have a Minnesota tax ID number,

read the instructions on the back and check the

appropriate box below.

Business address

City

State

Zip code

A

B

C

D

E

Name of seller from whom you are purchasing merchandise

Address

City

State

Zip code

Describe the merchandise normally sold in your business.

Describe the merchandise for which you are claiming exemption.

To qualify for exemption, the merchandise must be used in a trade or business at the location to which it is transported and may

not be returned to the city where purchased except in the course of interstate or intrastate commerce.

This purchase is exempt from

Minneapolis or

Rochester sales tax because:

The merchandise will be used in a trade or business outside the city limits.

The merchandise will be used on a construction contract outside the city limits.

City or location in Minnesota to which the merchandise is being shipped or transported

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. (PENALTY—If

you try to evade paying sales tax by using an exemption certificate for merchandise that will be used for purposes other than

those being claimed, you may be fined $100 under Minnesota law for each transaction for which the certificate is used.)

Signature of authorized purchaser

Title

Date

Stock No. 2100032

Printed on recycled paper with 10% post-consumer waste using soybased ink.

(Rev. 8/95)

1

1