Form Rb-1 - Bingo Tax Return - Illinois Department Of Revenue

ADVERTISEMENT

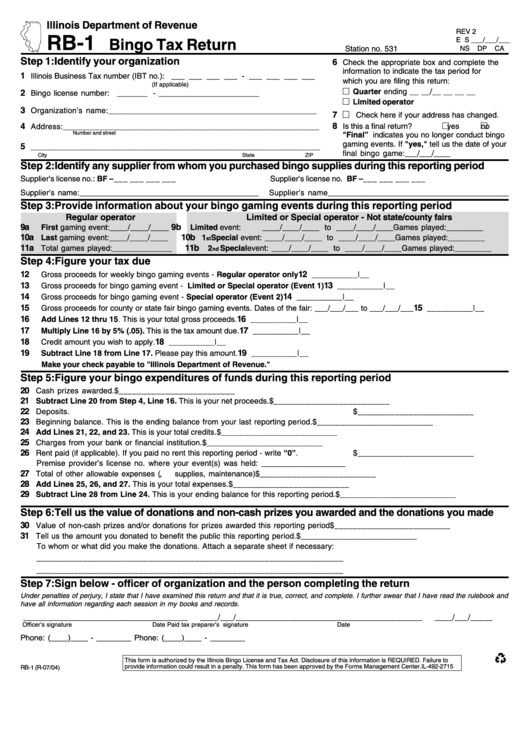

Illinois Department of Revenue

REV 2

RB-1

E S ___/___/___

Bingo Tax Return

Station no. 531

NS

DP

CA

Step 1: Identify your organization

6

Check the appropriate box and complete the

information to indicate the tax period for

1

Illinois Business Tax number (IBT no.): ___ ___ ___ ___ - ___ ___ ___ ___

which you are filing this return:

(If applicable)

Quarter ending __ __/__ __ __ __

2

Bingo license number:

_______ - _______________________

Limited operator

3

Organization’s name:______________________________________________

7

Check here if your address has changed.

8

4

Address:________________________________________________________

Is this a final return?

yes

no

Number and street

"Final” indicates you no longer conduct bingo

gaming events. If "yes," tell us the date of your

5

_______________________________________________________________

final bingo game:___/___/____

City

State

ZIP

Step 2: Identify any supplier from whom you purchased bingo supplies during this reporting period

Supplier's license no.: BF –___ ___ ___ ___

Supplier's license no. BF –___ ___ ___ ___

Supplier's name: _______________________________________

Supplier's name________________________________________

Step 3: Provide information about your bingo gaming events during this reporting period

Regular operator

Limited or Special operator - Not state/county fairs

9a

9b

First gaming event: ____/____/____

Limited event:

____/____/____ to ____/____/____ Games played: ________

10a

10b

Last gaming event: ____/____/____

1

Special event:

____/____/____ to ____/____/____ Games played: ________

st

11a

11b

Total games played: _____________

2

Special event: ____/____/____ to ____/____/____ Games played: ________

nd

Step 4: Figure your tax due

12

12

Gross proceeds for weekly bingo gaming events - Regular operator only

__________|__

13

13

Gross proceeds for bingo gaming event - Limited or Special operator (Event 1)

__________|__

14

14

Gross proceeds for bingo gaming event - Special operator (Event 2)

__________|__

15

15

Gross proceeds for county or state fair bingo gaming events. Dates of the fair: ___/___/___ to ___/___/___

__________|__

16

16

Add Lines 12 thru 15. This is your total gross proceeds.

__________|__

17

17

Multiply Line 16 by 5% (.05). This is the tax amount due.

__________|__

18

18

Credit amount you wish to apply.

__________|__

19

19

Subtract Line 18 from Line 17. Please pay this amount.

__________|__

Make your check payable to "Illinois Department of Revenue."

Step 5: Figure your bingo expenditures of funds during this reporting period

20

Cash prizes awarded.

$_________________________

21

Subtract Line 20 from Step 4, Line 16. This is your net proceeds.

$_________________________

22

Deposits.

$_________________________

23

Beginning balance. This is the ending balance from your last reporting period.

$_________________________

24

Add Lines 21, 22, and 23. This is your total credits.

$_________________________

25

Charges from your bank or financial institution.

$_________________________

26

Rent paid (if applicable). If you paid no rent this reporting period - write “0”.

$_________________________

Premise provider’s license no. where your event(s) was held: ___________________

27

Total of other allowable expenses ( i.e., supplies, maintenance)

$_________________________

28

Add Lines 25, 26, and 27. This is your total expenses.

$_________________________

29

Subtract Line 28 from Line 24. This is your ending balance for this reporting period.

$_________________________

Step 6: Tell us the value of donations and non-cash prizes you awarded and the donations you made

30

Value of non-cash prizes and/or donations for prizes awarded this reporting period

$_________________________

31

Tell us the amount you donated to benefit the public this reporting period.

$_________________________

To whom or what did you make the donations. Attach a separate sheet if necessary:

__________________________________________________________________

__________________________________________________________________

Step 7: Sign below - officer of organization and the person completing the return

Under penalties of perjury, I state that I have examined this return and that it is true, correct, and complete. I further swear that I have read the rulebook and

have all information regarding each session in my books and records.

_____________________________________

____/___/_____

_____________________________________

____/___/_____

Officer's signature

Date

Paid tax preparer's signature

Date

Phone: (____)____ - ________

Phone: (____)____ - ________

This form is authorized by the Illinois Bingo License and Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2715

RB-1 (R-07/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1