Instructions For Form 7540 - Employers' Expense Tax Return - Illinois Department Of Revenue

ADVERTISEMENT

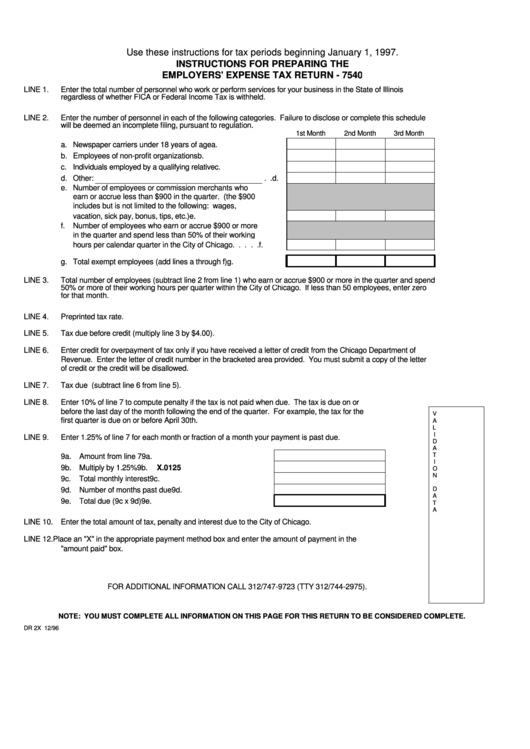

Use these instructions for tax periods beginning January 1, 1997.

INSTRUCTIONS FOR PREPARING THE

EMPLOYERS' EXPENSE TAX RETURN - 7540

LINE 1.

Enter the total number of personnel who work or perform services for your business in the State of Illinois

regardless of whether FICA or Federal Income Tax is withheld.

LINE 2.

Enter the number of personnel in each of the following categories. Failure to disclose or complete this schedule

will be deemed an incomplete filing, pursuant to regulation.

1st Month

2nd Month

3rd Month

a. Newspaper carriers under 18 years of age

. . . . . . . . . a.

b. Employees of non-profit organizations

. . . . . . . . . . . b.

c. Individuals employed by a qualifying relative

. . . . . . . . c.

d. Other:

. . d.

e. Number of employees or commission merchants who

earn or accrue less than $900 in the quarter. (the $900

includes but is not limited to the following: wages,

vacation, sick pay, bonus, tips, etc.)

. . . . . . . . . . . . e.

f.

Number of employees who earn or accrue $900 or more

in the quarter and spend less than 50% of their working

hours per calendar quarter in the City of Chicago

. . . . . f.

g. Total exempt employees (add lines a through f)

. . . . . g.

LINE 3.

Total number of employees (subtract line 2 from line 1) who earn or accrue $900 or more in the quarter and spend

50% or more of their working hours per quarter within the City of Chicago. If less than 50 employees, enter zero

for that month.

LINE 4.

Preprinted tax rate.

LINE 5.

Tax due before credit (multiply line 3 by $4.00).

LINE 6.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of

Revenue. Enter the letter of credit number in the bracketed area provided. You must submit a copy of the letter

of credit or the credit will be disallowed.

LINE 7.

Tax due (subtract line 6 from line 5).

LINE 8.

Enter 10% of line 7 to compute penalty if the tax is not paid when due. The tax is due on or

before the last day of the month following the end of the quarter. For example, the tax for the

V

first quarter is due on or before April 30th.

A

L

I

LINE 9.

Enter 1.25% of line 7 for each month or fraction of a month your payment is past due.

D

A

T

9a. Amount from line 7 . . . . . . . . . . . . . . . . . . 9a.

I

9b. Multiply by 1.25%

. . . . . . . . . . . . . . . . . . 9b.

X

.0125

O

N

9c.

Total monthly interest

. . . . . . . . . . . . . . . . 9c.

9d. Number of months past due . . . . . . . . . . . . . 9d.

D

A

9e. Total due (9c x 9d) . . . . . . . . . . . . . . . . . . 9e.

T

A

LINE 10. Enter the total amount of tax, penalty and interest due to the City of Chicago.

LINE 12. Place an "X" in the appropriate payment method box and enter the amount of payment in the

"amount paid" box.

FOR ADDITIONAL INFORMATION CALL 312/747-9723 (TTY 312/744-2975).

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

DR 2X 12/96

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1