Form Dr 653ut - Unemployment Tax Electronic Filing Agreement

ADVERTISEMENT

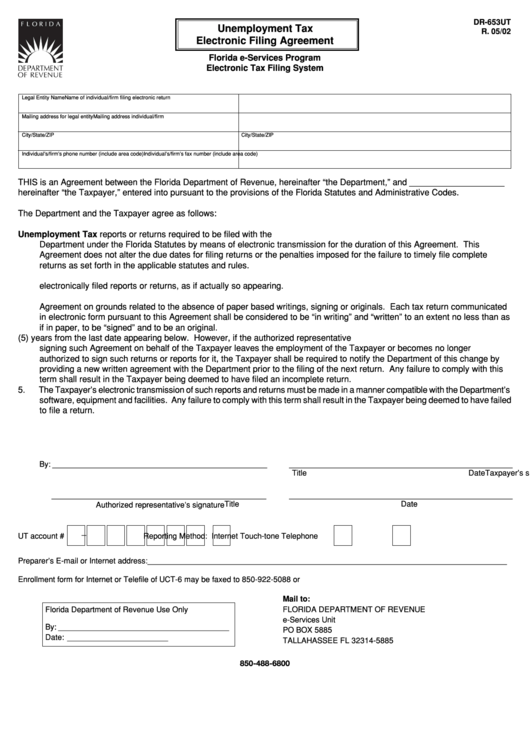

DR-653UT

Unemployment Tax

R. 05/02

Electronic Filing Agreement

Florida e-Services Program

Electronic Tax Filing System

Legal Entity Name

Name of individual/firm filing electronic return

Mailing address for legal entity

Mailing address individual/firm

City/State/ZIP

City/State/ZIP

Individual’s/firm’s phone number (include area code)

Individual’s/firm’s fax number (include area code)

THIS is an Agreement between the Florida Department of Revenue, hereinafter “the Department,” and ____________________

hereinafter “the Taxpayer,” entered into pursuant to the provisions of the Florida Statutes and Administrative Codes.

The Department and the Taxpayer agree as follows:

1.

The Department authorizes the Taxpayer to file Unemployment Tax reports or returns required to be filed with the

Department under the Florida Statutes by means of electronic transmission for the duration of this Agreement. This

Agreement does not alter the due dates for filing returns or the penalties imposed for the failure to timely file complete

returns as set forth in the applicable statutes and rules.

2.

The signature of the Taxpayer or its authorized representative affixed to this Agreement shall be deemed to appear on such

electronically filed reports or returns, as if actually so appearing.

3.

Neither party shall contest the validity or enforceability of the tax returns communicated in electronic form pursuant to this

Agreement on grounds related to the absence of paper based writings, signing or originals. Each tax return communicated

in electronic form pursuant to this Agreement shall be considered to be “in writing” and “written” to an extent no less than as

if in paper, to be “signed” and to be an original.

4.

The term of this Agreement is five (5) years from the last date appearing below. However, if the authorized representative

signing such Agreement on behalf of the Taxpayer leaves the employment of the Taxpayer or becomes no longer

authorized to sign such returns or reports for it, the Taxpayer shall be required to notify the Department of this change by

providing a new written agreement with the Department prior to the filing of the next return. Any failure to comply with this

term shall result in the Taxpayer being deemed to have filed an incomplete return.

5.

The Taxpayer’s electronic transmission of such reports and returns must be made in a manner compatible with the Department’s

software, equipment and facilities. Any failure to comply with this term shall result in the Taxpayer being deemed to have failed

to file a return.

6.

This Agreement can be amended at any time by the execution of a written addendum.

7.

This Agreement represents the entire understanding of the parties in relation to the electronic filing of returns and reports.

By: _________________________________________________

___________________________________________________

Taxpayer’s signature

Title

Date

_________________________________________________

___________________________________________________

Title

Date

Authorized representative’s signature

_

UT account #

Reporting Method:

Internet

Touch-tone Telephone

Preparer’s E-mail or Internet address: __________________________________________________________________________________

Enrollment form for Internet or Telefile of UCT-6 may be faxed to 850-922-5088 or

Mail to:

Florida Department of Revenue Use Only

FLORIDA DEPARTMENT OF REVENUE

e-Services Unit

By: _______________________________________

PO BOX 5885

Date: _______________________

TALLAHASSEE FL 32314-5885

850-488-6800

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1