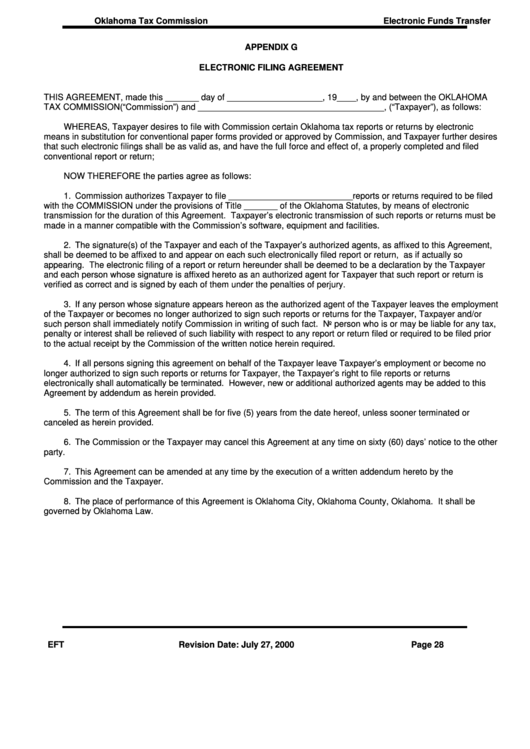

Form Eft - Appendix G - Electronic Filing Agreement

ADVERTISEMENT

Oklahoma Tax Commission

Electronic Funds Transfer

APPENDIX G

ELECTRONIC FILING AGREEMENT

THIS AGREEMENT, made this _______ day of ____________________, 19____, by and between the OKLAHOMA

TAX COMMISSION(“Commission”) and _______________________________________, (“Taxpayer”), as follows:

WHEREAS, Taxpayer desires to file with Commission certain Oklahoma tax reports or returns by electronic

means in substitution for conventional paper forms provided or approved by Commission, and Taxpayer further desires

that such electronic filings shall be as valid as, and have the full force and effect of, a properly completed and filed

conventional report or return;

NOW THEREFORE the parties agree as follows:

1. Commission authorizes Taxpayer to file __________________________reports or returns required to be filed

with the COMMISSION under the provisions of Title _______ of the Oklahoma Statutes, by means of electronic

transmission for the duration of this Agreement. Taxpayer’s electronic transmission of such reports or returns must be

made in a manner compatible with the Commission’s software, equipment and facilities.

2. The signature(s) of the Taxpayer and each of the Taxpayer’s authorized agents, as affixed to this Agreement,

shall be deemed to be affixed to and appear on each such electronically filed report or return, as if actually so

appearing. The electronic filing of a report or return hereunder shall be deemed to be a declaration by the Taxpayer

and each person whose signature is affixed hereto as an authorized agent for Taxpayer that such report or return is

verified as correct and is signed by each of them under the penalties of perjury.

3. If any person whose signature appears hereon as the authorized agent of the Taxpayer leaves the employment

of the Taxpayer or becomes no longer authorized to sign such reports or returns for the Taxpayer, Taxpayer and/or

such person shall immediately notify Commission in writing of such fact. No person who is or may be liable for any tax,

penalty or interest shall be relieved of such liability with respect to any report or return filed or required to be filed prior

to the actual receipt by the Commission of the written notice herein required.

4. If all persons signing this agreement on behalf of the Taxpayer leave Taxpayer’s employment or become no

longer authorized to sign such reports or returns for Taxpayer, the Taxpayer’s right to file reports or returns

electronically shall automatically be terminated. However, new or additional authorized agents may be added to this

Agreement by addendum as herein provided.

5. The term of this Agreement shall be for five (5) years from the date hereof, unless sooner terminated or

canceled as herein provided.

6. The Commission or the Taxpayer may cancel this Agreement at any time on sixty (60) days’ notice to the other

party.

7. This Agreement can be amended at any time by the execution of a written addendum hereto by the

Commission and the Taxpayer.

8. The place of performance of this Agreement is Oklahoma City, Oklahoma County, Oklahoma. It shall be

governed by Oklahoma Law.

EFT

Revision Date: July 27, 2000

Page 28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2