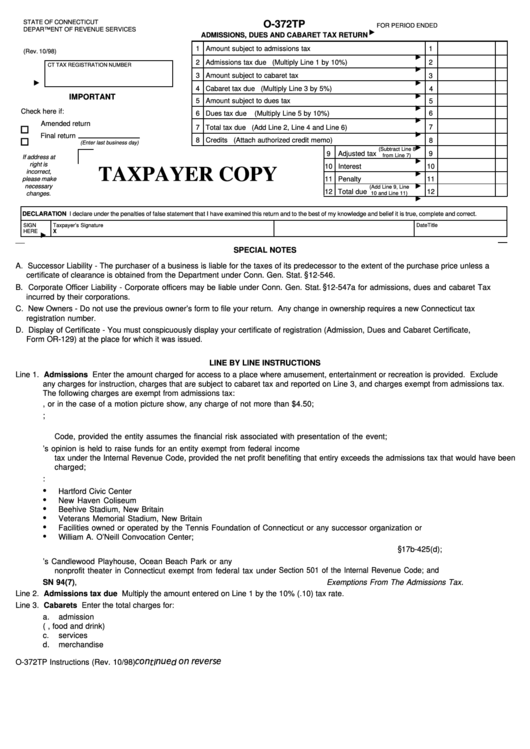

STATE OF CONNECTICUT

O-372TP

FOR PERIOD ENDED

DEPARTMENT OF REVENUE SERVICES

ADMISSIONS, DUES AND CABARET TAX RETURN

P.O. Box 5031 Hartford CT 06102-5031

1 Amount subject to admissions tax

1

(Rev. 10/98)

2 Admissions tax due (Multiply Line 1 by 10%)

2

CT TAX REGISTRATION NUMBER

3 Amount subject to cabaret tax

3

4 Cabaret tax due (Multiply Line 3 by 5%)

4

IMPORTANT

5 Amount subject to dues tax

5

Check here if:

6

6 Dues tax due

(Multiply Line 5 by 10%)

Amended return

7

7 Total tax due (Add Line 2, Line 4 and Line 6)

Final return

8 Credits (Attach authorized credit memo)

8

(Enter last business day)

(Subtract Line 8

9

Adjusted tax

9

from Line 7)

If address at

right is

10

Interest

10

TAXPAYER COPY

incorrect,

11

Penalty

11

please make

necessary

(Add Line 9, Line

12

Total due

12

changes.

10 and Line 11)

DECLARATION I declare under the penalties of false statement that I have examined this return and to the best of my knowledge and belief it is true, complete and correct.

SIGN

Taxpayer’s Signature

Title

Date

HERE

X

SPECIAL NOTES

A. Successor Liability - The purchaser of a business is liable for the taxes of its predecessor to the extent of the purchase price unless a

certificate of clearance is obtained from the Department under Conn. Gen. Stat. § 12-546.

B. Corporate Officer Liability - Corporate officers may be liable under Conn. Gen. Stat. § 12-547a for admissions, dues and cabaret Tax

incurred by their corporations.

C. New Owners - Do not use the previous owner’s form to file your return. Any change in ownership requires a new Connecticut tax

registration number.

D. Display of Certificate - You must conspicuously display your certificate of registration (Admission, Dues and Cabaret Certificate,

Form OR-129) at the place for which it was issued.

LINE BY LINE INSTRUCTIONS

Line 1. Admissions Enter the amount charged for access to a place where amusement, entertainment or recreation is provided. Exclude

any charges for instruction, charges that are subject to cabaret tax and reported on Line 3, and charges exempt from admissions tax.

The following charges are exempt from admissions tax:

a. any admission charge for less than one dollar, or in the case of a motion picture show, any charge of not more than $4.50;

b. daily admission charges to participate in an athletic or sporting activity;

c. admission charges to any event where all proceeds benefit an entity exempt from federal income tax under the Internal Revenue

Code, provided the entity assumes the financial risk associated with presentation of the event;

d. admission charges to any event that in the commissioner’s opinion is held to raise funds for an entity exempt from federal income

tax under the Internal Revenue Code, provided the net profit benefiting that entiry exceeds the admissions tax that would have been

charged;

e. admission charges to any event at the:

•

Hartford Civic Center

•

New Haven Coliseum

•

Beehive Stadium, New Britain

•

Veterans Memorial Stadium, New Britain

•

Facilities owned or operated by the Tennis Foundation of Connecticut or any successor organization or

•

William A. O’Neill Convocation Center;

f. admission charges paid by centers of services for elderly persons described in Conn. Gen. Stat. § 17b-425(d);

g. admission charges to productions featuring live performances at Gateway’s Candlewood Playhouse, Ocean Beach Park or any

nonprofit theater in Connecticut exempt from federal tax under Section 501 of the Internal Revenue Code; and

h. admission charges to any carnival or to any amusement ride. See SN 94(7), Exemptions From The Admissions Tax.

Line 2. Admissions tax due Multiply the amount entered on Line 1 by the 10% (.10) tax rate.

Line 3. Cabarets Enter the total charges for:

a.

admission

b.

refreshment (i.e., food and drink)

c.

services

d.

merchandise

O-372TP Instructions (Rev. 10/98)

1

1 2

2