Form Mo-1040p - Property Tax Credit/pension Exemption Short Form - 2011 Page 13

ADVERTISEMENT

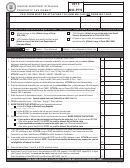

Attach a copy of Forms SSA-1099, a

Note:

letter from Social Security Ad min-

istration, a letter from Social Services

that includes the total amount of

assistance received and Employment

Security 1099, if applicable.

L

7 —

INE

Example:

N

L

(

)

ONBUSINESS

OSS

ES

Complete Line 7 only if nonbusiness

L

11 — O

Y

H

INE

WN

OUR

OME

losses reduced the amount reported

on Form MO-PTS, Line 1

Do

not include special assessments (sewer

lateral), penalties, service charges,

and interest listed on your tax receipt.

L

12 — R

Y

H

INE

ENT

OUR

OME

each

L

9 — F

S

INE

ILING

TATUS

D

EDUCTION

If you rent from a facility that does

not pay property taxes, you are not

eligible for a Property Tax Credit.

Single or Married Living Separate

Add the totals from Line 9 on all

Forms MO-CRP completed and enter

Married and Filing

on Line 12. Attach rent receipt(s) or

Combined

a signed statement from your land-

lord for any rent you are claiming,

along with Form MO-CRP. The rent

ENTIRE YEAR

receipt(s) or statement, must be signed

by the landlord and include his or her

Helpful Hint

tax identification or social security

did not

prior year

number and phone number. Copies of

ENTIRE YEAR

cannot

cancelled checks (front and back) will

be accepted if your landlord will not

L

10 — N

H

INE

ET

OUSEHOLD

provide rent receipts or a statement.

I

NCOME

Helpful Hint

ENTIRE YEAR

will not

ENTIRE YEAR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

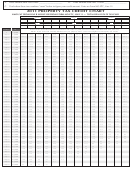

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22