Form Mo-1040p - Property Tax Credit/pension Exemption Short Form - 2011 Page 17

ADVERTISEMENT

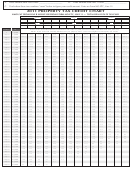

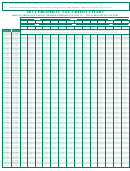

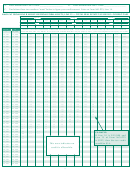

2011 PROPERTY TAX CREDIT CHART

AMOUNT FROM LINE B ABOVE OR FROM FORM MO-PTS, LINE 13 — TOTAL REAL ESTATE TAX PAID

Refund is the actual total amount of allowable real estate tax paid, not to exceed $1,100 (Form MO-PTS, Line 13).

FROM

TO

NOTE: If you rent from a facility that does not pay property taxes, you are not eligible for a Property Tax Credit.

1

14,300

14,301

14,600

14,601

14,900

14,901

15,200

15,201

15,500

15,501

15,800

15,801

16,100

16,101

16,400

16,401

16,700

16,701

17,000

17,001

17,300

17,301

17,600

17,601

17,900

17,901

18,200

18,201

18,500

18,501

18,800

18,801

19,100

19,101

19,400

19,401

19,700

19,701

20,000

20,001

20,300

20,301

20,600

20,601

20,900

20,901

21,200

21,201

21,500

21,501

21,800

21,801

22,100

22,101

22,400

22,401

22,700

22,701

23,000

23,001

23,300

23,301

23,600

23,601

23,900

23,901

24,200

24,201

24,500

24,501

24,800

24,801

25,100

25,101

25,400

25,401

25,700

25,701

26,000

26,001

26,300

26,301

26,600

26,601

26,900

26,901

27,200

27,201

27,500

27,501

27,800

27,801

28,100

28,101

28,400

28,401

28,700

28,701

29,000

29,001

29,300

29,301

29,600

29,601

29,900

29,901

30,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22