Form Mo-1040p - Property Tax Credit/pension Exemption Short Form - 2011 Page 4

ADVERTISEMENT

A

I E

?

M

LIGIBLE

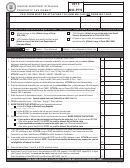

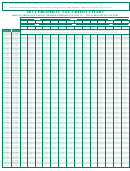

Use this diagram to determine if you or your spouse are eligible to claim the

PROPERTY TAX CREDIT (CIRCUIT BREAKER)

START DIAGRAM BY CHOOSING BOX 1 OR BOX 2 AND FOLLOW TO CONCLUSION.

NO

1

RENTERS / PART-YEAR OWNERS

single

married filing combined,

NO

OWNED AND OCCUPIED YOUR HOME THE ENTIRE YEAR

single

2

YES

married filing combined

N

OR

O

YES

T

NO

RENTERS:

E

YES

NO

L

I

YES

G

I

B

Box C

NO

NO

NO

NO

Box B

L

Box D

E

Box A

YES

YES

YES

YES

E L I G I B L E

TO OBTAIN FORMS

not

individual/

fax

Note:

machine handset

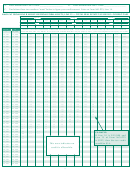

IMPORTANT FILING

INFORMATION

This information is for guidance only

and does not state the complete law.

F

R

ILING

EQUIREMENTS

individual/

W

T

F

HEN

O

ILE

Remember: An extension of time to

file does not extend the time to pay.

A 5 percent addition to tax will apply

E

T

F

XTENSION OF

IME TO

ILE

if the tax is not paid by the original

You are not required to file an ex ten sion

return’s due date.

if you do not expect to owe additional

income tax or if you anticipate receiv-

ing a refund.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

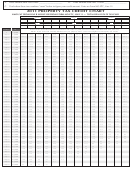

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22