Form 44-105 - Withholding Payment Voucher - Iowa Department Of Revenue

ADVERTISEMENT

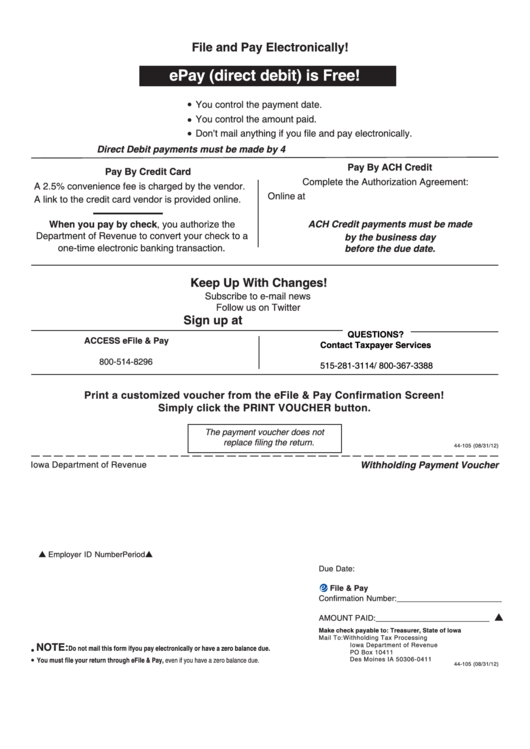

File and Pay Electronically!

ePay (direct debit) is Free!

.

You control the payment date.

.

You control the amount paid.

.

Don’t mail anything if you file and pay electronically.

Direct Debit payments must be made by 4 p.m. Central Time on the due date.

Pay By ACH Credit

Pay By Credit Card

Complete the Authorization Agreement:

A 2.5% convenience fee is charged by the vendor.

Online at

A link to the credit card vendor is provided online.

ACH Credit payments must be made

When you pay by check, you authorize the

Department of Revenue to convert your check to a

by the business day

one-time electronic banking transaction.

before the due date.

Keep Up With Changes!

Subscribe to e-mail news

Follow us on Twitter

Sign up at

QUESTIONS?

ACCESS eFile & Pay

Contact Taxpayer Services

idr@iowa.gov

800-514-8296

515-281-3114/ 800-367-3388

Print a customized voucher from the eFile & Pay Confirmation Screen!

Simply click the PRINT VOUCHER button.

The payment voucher does not

replace filing the return.

44-105 (08/31/12)

Withholding Payment Voucher

Iowa Department of Revenue

Employer ID Number

Period

Due Date:

File & Pay

Confirmation Number: ________________________

AMOUNT PAID: __________________________

Make check payable to: Treasurer, State of Iowa

Mail To:

Withholding Tax Processing

.

Iowa Department of Revenue

NOTE:

Do not mail this form if you pay electronically or have a zero balance due.

PO Box 10411

.

Des Moines IA 50306-0411

You must file your return through eFile & Pay, even if you have a zero balance due.

44-105 (08/31/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1