MONTANA

Clear Form

ESW

Rev 10 16

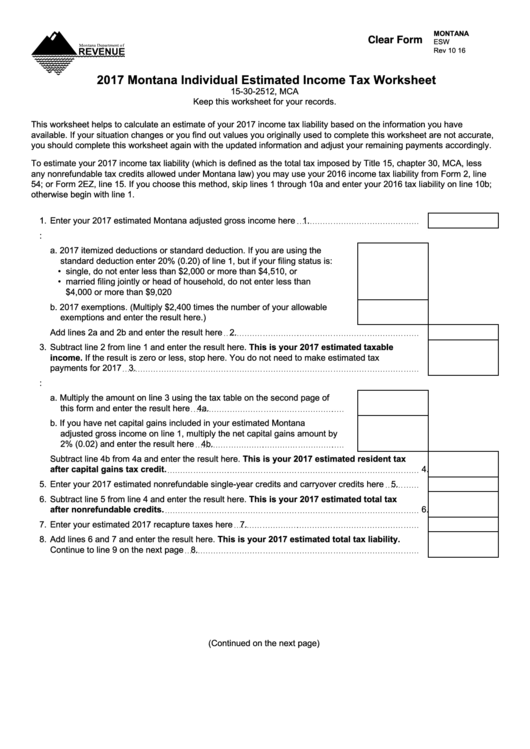

2017 Montana Individual Estimated Income Tax Worksheet

15-30-2512, MCA

Keep this worksheet for your records.

This worksheet helps to calculate an estimate of your 2017 income tax liability based on the information you have

available. If your situation changes or you find out values you originally used to complete this worksheet are not accurate,

you should complete this worksheet again with the updated information and adjust your remaining payments accordingly.

To estimate your 2017 income tax liability (which is defined as the total tax imposed by Title 15, chapter 30, MCA, less

any nonrefundable tax credits allowed under Montana law) you may use your 2016 income tax liability from Form 2, line

54; or Form 2EZ, line 15. If you choose this method, skip lines 1 through 10a and enter your 2016 tax liability on line 10b;

otherwise begin with line 1.

1. Enter your 2017 estimated Montana adjusted gross income here

1.

2. Enter the estimated amount of your:

a. 2017 itemized deductions or standard deduction. If you are using the

standard deduction enter 20% (0.20) of line 1, but if your filing status is:

• single, do not enter less than $2,000 or more than $4,510, or

• married filing jointly or head of household, do not enter less than

$4,000 or more than $9,020 ....................................................................... 2a.

b. 2017 exemptions. (Multiply $2,400 times the number of your allowable

exemptions and enter the result here.) ........................................................ 2b.

Add lines 2a and 2b and enter the result here

2.

3. Subtract line 2 from line 1 and enter the result here. This is your 2017 estimated taxable

income. If the result is zero or less, stop here. You do not need to make estimated tax

payments for 2017

3.

4. Calculate your estimated 2017 income tax:

a. Multiply the amount on line 3 using the tax table on the second page of

this form and enter the result here

4a.

b. If you have net capital gains included in your estimated Montana

adjusted gross income on line 1, multiply the net capital gains amount by

2% (0.02) and enter the result here

4b.

Subtract line 4b from 4a and enter the result here. This is your 2017 estimated resident tax

after capital gains tax credit.

4.

5. Enter your 2017 estimated nonrefundable single-year credits and carryover credits here

5.

6. Subtract line 5 from line 4 and enter the result here. This is your 2017 estimated total tax

after nonrefundable credits.

6.

7. Enter your estimated 2017 recapture taxes here

7.

8. Add lines 6 and 7 and enter the result here. This is your 2017 estimated total tax liability.

Continue to line 9 on the next page

8.

(Continued on the next page)

1

1 2

2 3

3