Form 3978 - Fuel Supplier Return Page 2

Download a blank fillable Form 3978 - Fuel Supplier Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 3978 - Fuel Supplier Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

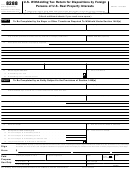

Form 3978, Page 2

Ethanol Blends

Undyed Petroleum Undyed Biodiesel

Dyed Diesel

See instructions for further information.

Schedule

Gasoline

Aviation

(E70 - E99)

Diesel

(B05 or higher)

(petroleum/biodiesel)

PART 2: REPORTABLE INFORMATION

2C

28. Imports from outside the U.S.

3

29. Imports from another state.

2X

30.

Fuel received on exchange.

6X

31. Fuel delivered on exchange.

10B

32. FTZ disbursements.

11A

33. Dyed diesel diverted TO Michigan.

PART 3: TAXABLE DISBURSEMENTS

5/5Z

34. Michigan taxable gallons.

5C

35. Aviation fuel sold to authorized resellers.

5F

36. Taxable dyed diesel disbursements.

7B

37. Michigan taxable gallons sold for export.

38. Add lines 34-37.

PART 4: OTHER TERMINAL DISBURSEMENTS

6F

39. Dyed diesel removed.

6P

40.

Sales to suppliers for exports.

7A

41. Exports with destination tax collected.

8

42. Deliveries to U.S. Government.

9

43. Deliveries to state and local governments.

6Z

44. Leaded Racing Fuel disbursed

10F

45. Deliveries to tax-free storage.

10G

46. Deliveries to exempt institutions.

10M

47. Deliveries to fuel feedstock users.

48. Nontaxable use (form 680).

11B

49. Diversions FROM Michigan.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5