Form 5083 - Fuel Supplier And Wholesaler Prepaid Sales Tax Schedule - Michigan Department Of Treasury - 2017

ADVERTISEMENT

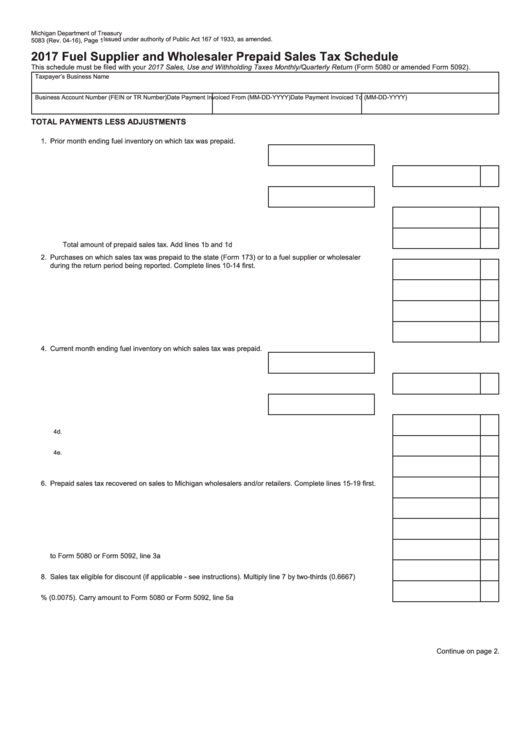

Michigan Department of Treasury

Issued under authority of Public Act 167 of 1933, as amended.

5083 (Rev. 04-16), Page 1

2017 Fuel Supplier and Wholesaler Prepaid Sales Tax Schedule

This schedule must be filed with your 2017 Sales, Use and Withholding Taxes Monthly/Quarterly Return (Form 5080 or amended Form 5092).

Taxpayer’s Business Name

Business Account Number (FEIN or TR Number)

Date Payment Invoiced From (MM-DD-YYYY)

Date Payment Invoiced To (MM-DD-YYYY)

ToTal PaymenTS leSS adjuSTmenTS

1. Prior month ending fuel inventory on which tax was prepaid.

a. Gasoline gallons ....................................................................

1a.

b. Sales tax prepaid on gallons reported on line 1a. .................................................................................

1b.

c. Diesel gallons. .......................................................................

1c.

d. Sales tax prepaid on gallons reported on line 1c...................................................................................

1d.

e.

Total amount of prepaid sales tax. Add lines 1b and 1d ........................................................................

1e.

2. Purchases on which sales tax was prepaid to the state (Form 173) or to a fuel supplier or wholesaler

during the return period being reported. Complete lines 10-14 first.

a. Sales tax prepaid on gasoline. Carry amount from line 13. ...................................................................... 2a.

b. Sales tax prepaid on diesel. Carry amount from line 14. .......................................................................... 2b.

c. Total amount of prepaid sales tax attributable to purchases made this period. Add lines 2a and 2b ....... 2c.

3. Total prepaid sales tax in beginning inventory plus purchases. Add lines 1e and 2c .....................................

3.

4. Current month ending fuel inventory on which sales tax was prepaid.

a. Gasoline gallons. ...................................................................

4a.

b. Sales tax prepaid on gallons reported on line 4a. .................................................................................

4b.

c. Diesel gallons. .......................................................................

4c.

d. Sales tax prepaid on gallons reported on line 4c...................................................................................

4d.

e. Total amount of prepaid sales tax. Add lines 4b and 4d ........................................................................

4e.

5. Adjusted prepayments of sales tax on purchases. Subtract line 4e from line 3 .............................................

5.

6. Prepaid sales tax recovered on sales to Michigan wholesalers and/or retailers. Complete lines 15-19 first.

a. Prepaid sales tax recovered for gasoline. Carry amount from line 18 ...................................................... 6a.

b. Prepaid sales tax recovered for diesel. Carry amount from line 19 .......................................................... 6b.

c. Total amount of prepaid sales tax recovered. Add lines 6a and 6b .......................................................... 6c.

7. Prepaid sales tax recoverable on sales tax return. Subtract line 6c from line 5. Enter result here and carry

to Form 5080 or Form 5092, line 3a ...............................................................................................................

7.

8. Sales tax eligible for discount (if applicable - see instructions). Multiply line 7 by two-thirds (0.6667) ...........

8.

9. Multiply line 8 by 0.75% (0.0075). Carry amount to Form 5080 or Form 5092, line 5a ..................................

9.

Continue on page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3