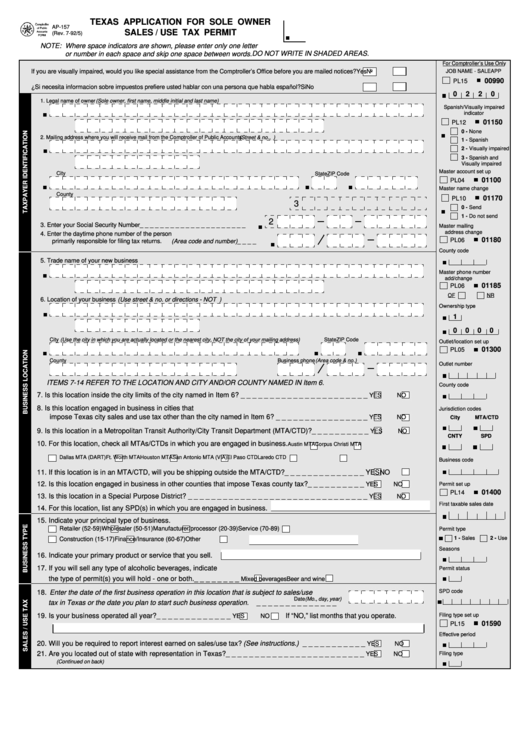

TEXAS APPLICATION FOR SOLE OWNER

AP-157

SALES / USE TAX PERMIT

(Rev. 7-92/5)

NOTE: Where space indicators are shown, please enter only one letter

DO NOT WRITE IN SHADED AREAS.

or number in each space and skip one space between words.

For Comptroller’s Use Only

If you are visually impaired, would you like special assistance from the Comptroller’s Office before you are mailed notices?

Yes

No

JOB NAME - SALEAPP

00990

PL15

¿Si necesita informacion sobre impuestos prefiere usted hablar con una persona que habla español?

Si

No

0

2

2 0

1. Legal name of owner (Sole owner, first name, middle initial and last name)

Spanish/Visually impaired

indicator

01150

PL12

0 - None

2. Mailing address where you will receive mail from the Comptroller of Public Accounts (Street & no., P.O. Box or Rural Route and box no.)

1 - Spanish

2 - Visually impaired

3 - Spanish and

Visually impaired

Master account set up

City

State

ZIP Code

01100

PL04

Master name change

County

01170

PL10

3

0 - Send

1 - Do not send

2

3. Enter your Social Security Number _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Master mailing

address change

4. Enter the daytime phone number of the person

01180

PL06

primarily responsible for filing tax returns.

(Area code and number) _ _ _ _

County code

5. Trade name of your new business

Master phone number

add/change

01185

PL06

OF

NR

6. Location of your business (Use street & no. or directions - NOT P.O. Box or Rural Route no.)

Ownership type

1

0

0

0 0

City (Use the city in which you are actually located or the nearest city, NOT the city of your mailing address)

State

ZIP Code

Outlet/location set up

01300

PL05

County

Business phone (Area code & no.)

Outlet number

ITEMS 7-14 REFER TO THE LOCATION AND CITY AND/OR COUNTY NAMED IN Item 6.

County code

7. Is this location inside the city limits of the city named in Item 6? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

8. Is this location engaged in business in cities that

Jurisdiction codes

impose Texas city sales and use tax other than the city named in Item 6? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

City

MTA/CTD

9. Is this location in a Metropolitan Transit Authority/City Transit Department (MTA/CTD)? _ _ _ _ _ _ _ _ _ _

YES

NO

CNTY

SPD

10. For this location, check all MTAs/CTDs in which you are engaged in business.

Austin MTA

Corpus Christi MTA

Dallas MTA (DART)

Ft. Worth MTA

Houston MTA

San Antonio MTA (VIA)

El Paso CTD

Laredo CTD

Business code

11. If this location is in an MTA/CTD, will you be shipping outside the MTA/CTD? _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

12. Is this location engaged in business in other counties that impose Texas county tax? _ _ _ _ _ _ _ _ _ _

YES

NO

Permit set up

01400

PL14

13. Is this location in a Special Purpose District? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

First taxable sales date

14. For this location, list any SPD(s) in which you are engaged in business.

15. Indicate your principal type of business.

Retailer (52-59)

Wholesaler (50-51)

Manufacturer/processor (20-39)

Service (70-89)

Permit type

1 - Sales

2 - Use

Construction (15-17)

Finance/Insurance (60-67)

Other

Seasons

16. Indicate your primary product or service that you sell.

17. If you will sell any type of alcoholic beverages, indicate

Permit status

the type of permit(s) you will hold - one or both. _ _ _ _ _ _ _ _

Mixed beverages

Beer and wine

18. Enter the date of the first business operation in this location that is subject to sales/use

SPD code

Date (Mo., day, year)

tax in Texas or the date you plan to start such business operation. _ _ _ _ _ _ _ _ _ _ _ _ _ _

19. Is your business operated all year? _ _ _ _ _ _ _ _ _ _ _ _ _

If “NO,” list months that you operate.

Filing type set up

YES

NO

01590

PL15

Effective period

20. Will you be required to report interest earned on sales/use tax? (See instructions.) _ _ _ _ _ _ _ _ _ _ _

YES

NO

21. Are you located out of state with representation in Texas? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Filing type

YES

NO

(Continued on back)

1

1 2

2